Crypto for Canadians 101: Lecture 1 — Starting a Position

If you live in Canada and investing in cryptocurrency has only begun to pique your interest (but you don’t know where to start), you have come to the right place.

As someone who has been invested in Bitcoin and Ethereum since 2017, I have tangible experience onboarding countless members of my network into the community.

Don’t know what Ethereum is? That’s an entirely different rabbit hole I won’t get into details about here. This post is mainly designed for those who have taken a liking to cryptocurrencies but are unsure how to actually get skin in the game.

In my experience, I have found that starting positions in crypto assets usually sets off a chain reaction that leads investors down the path of boundless research. I believe it is essential for everyone to have some knowledge of blockchains, and understand where this technology is headed in the future.

If purchasing crypto is the best way to get Canadians to “do their homework,” then it is my job to act as a guide.

Disclosure: None of this is financial advice.

Please be advised this post will also include many referral links (not because I care to make an extra $10 by selling you on these products, but because there are usually added benefits given for signing up with a referral code).

The most common statement I hear about cryptocurrency, even to this day:

“I want to invest, but I don’t know where to start.”

Lucky for you, today, the options are aplenty. In this post, I will detail many different ways you can get exposure to Bitcoin and Ethereum. I will lay out some pros and cons of each method and tell you about my personal experiences.

My goal is to make you more comfortable when investing in crypto. You are by no means guaranteed to make money, but at least you will understand your options and pick the ones that best suit your needs.

Option 1: Crypto ETFs (Exchange Traded Funds)

These are quite new in the world of crypto, but they were a long time coming.

For those with experience buying and selling equities in their TFSA, RRSP, or any other trading account, you will likely understand what an ETF is. If you do not, here is a resource to get you started.

Crypto ETFs are probably the easiest way to get exposure to assets like Bitcoin and Ethereum. For starters, you won’t have to worry about setting up an account on a brand new exchange, as you probably already have a trading account. If you don’t have a TFSA, I would recommend you go open one right now!

There are currently two types of crypto ETFs that exist today:

Closed-ended funds (QBTC, BTCG, QETH)

3iQ’s QBTC was the first of its kind to market. With an annual management fee of 1.95% (which is now is considered expensive), it offered the very first way for Canadians to add Bitcoin exposure into their registered savings accounts.

Gemini is QBTC’s custodian, meaning that all Bitcoin owned by the fund is held in Gemini’s Trust — making the Bitcoin very secure.

In essence, by purchasing a share of QBTC, you are purchasing a fraction of the Bitcoin that the fund owns. As of this writing, each share is worth 0.00112391 Bitcoin.

As a result of the fund’s structure, you are able to calculate the Net Asset Value (NAV) of each share at any given time. This number also updates on their website each day. Being the first mover (and the only true way to buy Bitcoin in a TFSA until very recently), the share price would regularly trade far higher than the NAV due to demand. CI Galaxy’s BTCG followed soon after with a slightly lower expense ratio of 1.8%. Still, both funds traded at a premium to NAV until very recently.

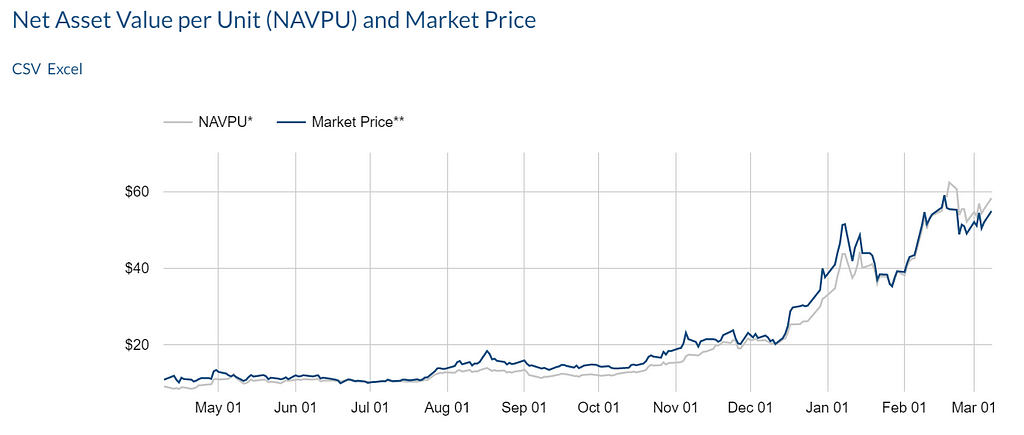

Below is a chart comparing the Net Asset Value of QBTC to its market price from May 2020 to March 2021.

You can see in the chart above that while QBTC traded above the NAV for close to one year, it has recently traded below the NAV, meaning it has been trading at a discount to the actual price of Bitcoin. This is due to the availability of newer, alternative products that can provide exposure to Bitcoin in registered accounts. The competition has increased — more on this below.

A quick note on Ethereum: QETH currently remains the only option for owning Ethereum in an RRSP or TFSA at this time, though competitive funds should follow soon.

Open-ended funds (BTCC, EBIT)

As of this writing, these are only one month old, and they destroyed the premiums over NAV on the closed-ended funds.

Purpose Investment’s BTCC was the first to market, offering a low management fee of 1%. Evolve’s EBIT followed soon after and lowered their fee to 0.75% in order to compete.

From the Purpose Investments website on how these funds work:

1. You, the investor, purchase ETF units on the Toronto Stock Exchange (TSX) just the same as you would purchase any other stock or ETF.

2. Purpose will then use your proceeds to purchase Bitcoin from institutional-grade liquidity providers.

3. The Bitcoin is then settled and stored into our secure, offline wallet (also known as a cold wallet)

4. Similar to commodity funds, as the investor you now own units of the ETF, which owns physically settled Bitcoin

In other words, by purchasing BTCC, you are giving Purpose Investments money to buy you Bitcoin at a competitive rate, close to the market price.

The reality is, paying 1–2% annually for a company to hold your Bitcoin or Ethereum is the cost of doing business on the stock market. It will always be an investment vehicle to consider when looking for tax-free crypto gains. Not to mention, there is always a fee associated with acquiring crypto-assets, some greater than others.

The concern that the crypto community would have with the above-mentioned options is also a famous quote in the blockchain world: not your keys, not your crypto.

“Not your keys, not your crypto” essentially refers to a centralized institution holding money on your behalf. In essence, it somewhat defeats the entire purpose of cryptocurrency as it’s the opposite of decentralization. If the company holding your money were to go under, what happens to your assets?

It is worth pointing out that some believe there are higher risks associated with holding your own assets, therefore preferring to own products such as the above-listed ETFs instead. To each their own.

Overall, ETFs are the simplest way to expose yourself to Bitcoin and Ethereum.

Option 2: Wealthsimple Crypto & Mogo Crypto

These are the two options that initially come to mind when a Canadian wants to consider buying non-transferrable crypto.

With products such as Wealthsimple Crypto, you pay a one-time trading fee to buy crypto assets like Bitcoin or Ethereum. However, you can’t actually do anything with the crypto you purchase. It is held by Wealthsimple until the moment you decide to exit. No trading, no spending, no yield earning, no decentralization. You will also be hit with a capital gains tax when you sell, assuming you are in the green.

I do hope one-day Wealthsimple allows you to transfer your crypto elsewhere, without having to sell. Robinhood just greenlit this feature. I wonder why…

Overall, Wealthsimple Crypto is a headache-free choice for Canadians, but not my preferred choice (and definitely not the preferred choice of the crypto community). If this is the path you decide to go down, at least be sure to use a referral code to get some free money when you sign up.

Option 3: Shakepay & Newton

These are my preferred Canadian gateways into the crypto universe. They are exchanges that require you to submit a KYC (Know Your Customer) when signing up in order to use their services. Those familiar with these purchasing methods would refer to them as “fiat onramps into crypto.”

Good luck trying to buy crypto anywhere using a Canadian credit card. I wouldn’t even bother trying.

Thus, Shakepay is my go-to source these days for adding crypto exposure.

Funding your account takes no more than a few minutes through an Interac e-transfer. Buying the crypto takes seconds. Shakepay also has a promotion called #ShakingSats, in which you literally shake your phone each day for free Bitcoin. There are a few steps required in activating the promotion, including the use of a referral code. They even give you free money with your first purchase of $100 or more.

Newton competes with Shakepay and offers you a free $25 when you purchase at least $100 worth of crypto for the first time (only when you use a referral code).

These exchanges market themselves as being commission-free. How do they make money? They charge you a price for Bitcoin that is 1–2% higher than the market rate (aka a spread). For example, if Bitcoin is worth 60,000 CAD, the price on Shakepay might be over $61,000.

To summarize, Shakepay and Newton charge a one-time fee (paid on the spread) each time you buy and sell crypto. These are the most competitive rates available today in Canada. I have found the cost of crypto-assets to be slightly lower on Newton than Shakepay, but it’s quite marginal.

It is also important to note that I do not hold my crypto assets on these exchanges, and wouldn’t recommend that strategy to anyone. I simply use Shakepay to convert my CAD into Bitcoin and then send the funds to my own personal offline cold storage hardware wallet.

It’s free to send your crypto off of Shakepay to another wallet of your choice — another great perk! I have many different Bitcoin and Ethereum addresses, and so should you. Newton has since moved away from free withdrawals, but they cover a portion of the fee (up to $5).

There are flaws to be wary about though. Customer service at these exchanges can take a long time to reply. They’re growing faster than they can hire. All you have to do is check out the Subreddit to hear about countless bad experiences.

I strictly use Shakepay to convert cash into crypto and immediately withdraw the tokens after purchasing. I have zero intention of using Shakepay as a crypto wallet, or an exit strategy. As such, I’ve never had an issue.

Last, but not least, Shakepay only offers users the ability to purchase Bitcoin and Ethereum (at this time). Newton has a few more options than that, but not many. I regularly send my crypto elsewhere to buy additional tokens I am excited about (hello, Uniswap & Binance).

More on how to store your crypto (and trade altcoins) another day.

Option 4: Gemini, Coinbase, Kraken et all

Ah, the OG way to buy crypto — a good ol’ wire transfer.

This was the way I purchased my first crypto assets back in 2017. I sent a wire from my bank to Gemini. Yes, you have to physically go into the bank to do it.

The bank teller frankly had no clue what they were doing or what I was doing, to be honest. The instructions provided by the exchange (Gemini) can be somewhat complicated to understand for those not too familiar with sending wire transfers. Do your best to follow them.

It is also important for you to know about the fees associated with wiring money to a crypto exchange. Your bank will charge you a wire processing fee. Gemini takes a wire receiving fee. Plus, you’ll still have to pay another transaction fee when buying the actual crypto. Unless you’re wiring thousands of dollars at a time, Shakepay is a better cost-saving alternative for Canadians.

There is value in having a verified bank account associated with your Gemini or Coinbase account, however. These are the best exchanges for exit strategies. I can only speak for Gemini, but when you’re ready to withdraw back into CAD, having a bank account linked with a trusted crypto exchange should be a reliable method. More on selling crypto and withdrawing fiat (cash) another day.

These exchanges also have plenty of altcoins you can dabble in — an added bonus for having funded accounts open with them.

Here is a Gemini referral code if you’re looking to open an account. We’ll both get a free $10 if you sign up and purchase $100 worth of crypto.

Whatever you do, DO NOT use a Visa Debit to buy crypto on Gemini. You’ll be paying something like a 5% fee. Do a wire transfer, or use Shakepay.

Side note: Kraken lets you fund your account through Canada Post, but I’ve never actually had an account on the site or tried that method. Dan Held is a great Twitter follow though.

I hope at this point you have a better understanding of how to purchase your first crypto assets!

Check back for my next installment: Crypto for Canadians 101: Lecture 2— Holding Your Crypto Assets Securely. I’ll do a dive into Ledger hardware wallets and buying DeFi altcoins on exchanges like Binance!

If you are really interested in learning more, I recommend checking out the Bankless podcast. David and Ryan do a great job of onboarding the world into crypto, and I personally listen to every episode. They just summarized their first 8 episodes in a one-year anniversary special, and you should check it out!

Think I might have missed something? Let me know in the comments!

This guide may still be confusing for some. That’s OK. Shoot me a DM on LinkedIn, reach out on Twitter, or send over an e-mail to [email protected] if you have any questions on how to get started! I am here to help — don’t be a stranger!

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

https://medium.com/media/3b6b127891c5c8711ad105e61d6cc81f/href

Crypto for Canadians 101: Lecture 1 — Starting a Position was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.