What are Wrapped Coins? — What Do They Mean for Nigerians?

Ever since the growth of the Ethereum network, the protocol has attracted a lot of traffic.

For the longest time, this was a detriment for all the other coins on a different blockchain.

Thanks to the invention of wrapped coins and tokens, this no longer has to be the case.

Both tokens and coins can be wrapped in Ethereum blockchain.

Here is an in-depth discussion of the difference between coins and tokens posted on Remitano.

What is a Wrapped Asset?

The short and to-the-point answer is that a wrapped coin is being transferred to the Ethereum blockchain but maintains its original price.

This is possible for assets originating in other blockchains, a different distributed ledger, or even for assets not native to the Distributed Ledger world.

This works under the ERC-20 standard. A token representing the original asset and price is created either through a smart contract or by using a one-to-one peg with an asset outside the blockchain, like fiat money.

A stable coin such as USDT is a wrapped version of the US dollar backed by the physical USD held somewhere.

We can see that FIAT-backed stable coins were the first examples of a wrapped asset.

This could be done in any protocol that supports smart contracts, but right now, the blockchain attracts the most hidden assets in Ethereum.

This is due to its large pool of DeFi apps and the liquidity of its decentralized exchanges.

How Does It Work?

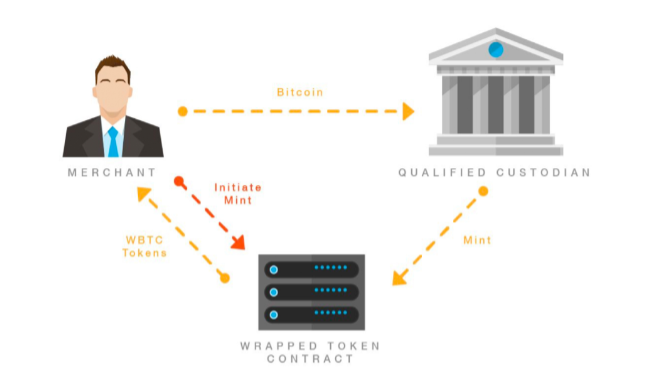

First, we need an interested party looking to mint some wrapped tokens on the Ethereum blockchain. We will use Bitcoin in this example.

The user initiates a request to issue wrapped Bitcoin Tokens (WBTC) to the smart contract provider.

Then he proceeds to send the equivalent amount in Bitcoin to the custodian institution that will lock the funds.

The custodian sends a confirmation to the smart contract, and the user receives WBTC equivalent to what he has deposited.

The wrapped token in the case of crypto assets is exchanged 1 to 1 for the underlying asset.

This means once the original user has traded his WBTC and the new holder wants BTC, he can get them unlocked.

Alternatively, he can sell WBTC for BTC on an exchange and get the same amount since the ratio is 1 to 1.

Of course, by selling it on an exchange, the fees are deducted from the transaction.

This is very convenient because it means coins and tokens from blockchains not native to Ethereum can be easily traded.

Instead of complex operations like atomic swaps between both parties or other forms of blockchain interoperability.

This has become very popular, and many DeFi protocols are issuing wrapped assets on Ethereum.

The Success of WBTC

In January of last year, Bitgo, Ren, and Kyber network announced the creation of wrapped Bitcoin.

It was going to be an ERC-20 pegged to the price of Bitcoin to operate in the Ethereum network.

The original idea was to bring the liquidity of BTC into Ethereum and bolster interoperability between blockchains.

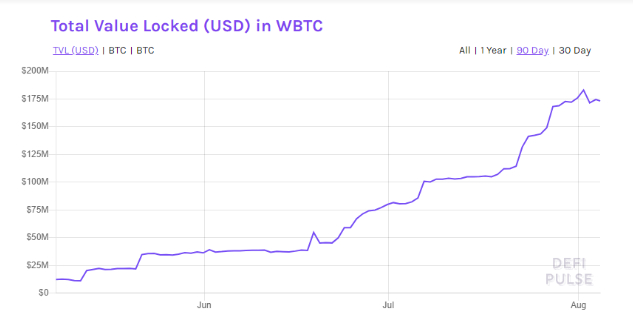

In the beginning, it managed to attract enough attention to have 558 BTC locked for the first part of 2019.

The attention it gathered was almost immediate, and it has grown at an astounding rate.

Today it has over 15,000 BTC locked in or 173 million dollars, according to DeFi Pulse.

This has led to an increase in the adoption of Wrapped Bitcoin.

In the second half of 2019, power players such as Compound, Uniswap, Gnosis, and many others launched trading platforms in WBTC.

This means demand for the asset will only increase as time moves on. There are more than 20 platforms now working with WBTC, and there is no sign of it slowing down.

The picture below shows all exchanges and DeFi products accepting WBTC.

Notably, now WBTC is part of the basket of assets used in DAI. This attracted attention from all over the crypto space.

Another popular wrapped coin is Zcash. As we know, Zcash is a privacy-focused coin.

The transactions done from Zcash wallet to Zcash wallet are almost impossible to trace and has become one of the success stories of the privacy niche.

In October of 2019, Zcash was tokenized into the Ethereum network. This will bring the demand and liquidity of the Zcash network to Ethereum.

But the benefits run both ways; now, Zcash users can access the many DeFi services launched on the Ethereum network, the main space for DeFi right now.

The move has attracted even more attention, and there are even more wrapped coins in the works.

Ethereum is not the only coin benefiting from this. Early this year, the first wrapped Bitcoin in the Bitcoin cash network began to circulate.

The faster transaction speed and lower fees of BCH have made an attractive alternative.

The name of the wrapped Bitcoin is BTC2, and it has begun to gain traction across exchanges.

What Other Wrapped Assets are There?

Interestingly enough, one of the most popular besides WBTC is wrapped Ether.

The coin ETH in its native status to the Ethereum network does not have the properties as an ERC-20 token.

This gave birth to the WETH, which is an ERC-20 token and has all of its properties.

The main use of WETH is for the creation of smart contracts for flash loans.

It simplifies the interface of the contract since it only has to account for ERC-20 tokens and not Ether and tokens.

The growth of flash loans in platforms such as Aave and dy/dx has meant an increased minting of wrapped Ether.

We have already discussed how FIAT-backed stable coins are actually just a wrapped physical asset converted into an ERC-20.

Some of the future uses of this type of technology are found in the equity markets where corporate bonds or even municipal debt could be wrapped and placed on the blockchain.

The regulatory demands would be greater, but the gains are hard to understate.

This would bring a whole new class of buyers to these types of assets transferring a lot more liquidity to the blockchain.

The future is bright for such a young technology.

,The increased evolution of blockchain is not slowing down and the impact will be far-reaching.

Why are Wrapped Coins Important to the Nigerian Market?

Bitcoin remains the most trusted asset in the world of cryptocurrencies.

This means it is the most desirable coin to buy and do transactions with, but it is also expensive.

Of course, not in the sense of its price per coin, we mean the transaction fees of the Bitcoin network.

For large amounts of BTC, let’s say above 0.5 Bitcoin, using the Bitcoin network is fine.

But for small transactions, the network fees eat up the original value. It is very impractical to use it this way, and sadly, this is also true for Ethereum.

The latest bull run and DeFi explosion have led to a parabolic increase in the price of gas.

As such, it is also too expensive to move WBTC for small amounts.

As a result of this expensive transaction fee and slow transfer rate, the lightning network was developed.

Read more about Bitcoin’s Lightning Network: What Is it and How Does it Work? on Remitano.

The best alternative right now is BTC2 in the Bitcoin Cash network.

As mentioned before, this is a 1 to 1 wrapped coin in the BCH network using Bitcoin Cash transaction fees.

Due to the speed and larger block size of BCH, this is the best alternative to BTC for small amounts of money out there. The fees charged range from $0.001 to $0.07.

Finally, Tezos has entered the race with TZBTC, a project for a Wrapped Bitcoin token hosted on Tezos.

The token will be created using the FA1.2 standard, which is native to Tezos.

This, if implemented correctly, could be another great way to buy and move Bitcoin without paying expensive fees.

Both BTC2 and TZBTC are the best options to own and use Bitcoin in Nigeria.

The Bitcoin and Ethereum network has become too expensive due to the latest bull run.

So, for those of us looking to buy and transfer small amounts of Bitcoin, the BCH and Tezos network are our best choice.

Vitalik Buterin Bitcoin Magazine Bitcoin Max

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

https://medium.com/media/3b6b127891c5c8711ad105e61d6cc81f/href

What are Wrapped Coins? — What Do They Mean for Nigerians? was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.