During Bitcoin’s 2017 $20k parabolic top, the market gave us just 12 full trading days to sell above $15k before sellers took control.

This week in Crypto

This previous week has been characterized by more sideways consolidation of Bitcoin, which has the distinctive feel of re-accumulation by investors as dips have been bought up quickly and on-chain metrics support this thesis by showing that prices are well supported at these close to all-time-high levels. Roughly 12% of all Bitcoin supply has now moved whilst Bitcoin has maintained a market capitalization of over $1trillion, representing a movement between buyers and sellers of BTC around the ~$54k price mark (source: Glassnode + @woonomic). It is also noteworthy that BTC has held above the hugely significant price level of $50k for over 36 days now, not a trend that that typically signifies a market (blow off) top when traders and investors are given very little time and liquidity to sell the actual top. As a comparison, during the 2017 $20k parabolic top, the market gave us just 12 full trading days to sell above $15k before sellers took control and we started the painful bear market into crypto winter.

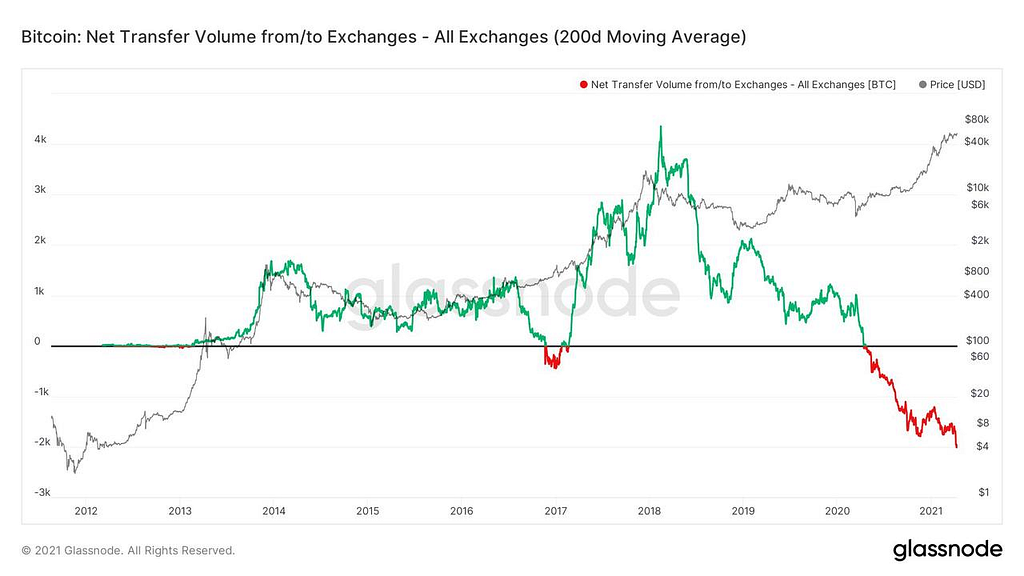

Combined with the continued trend of a net outflow of coins from all exchanges and into cold storage, all the signs are there that these past 6 weeks or so are just a pause in the current bull market. It certainly feels that another leg up is due once this latest phase of accumulation has played out. The first chart below (courtesy of Glassnode via @cryptoquant) shows this continuing trend of BTC leaving exchanges and reducing the physical BTC free float available for investors to buy and market makers to trade. If the popular market consensus is that BTC price should top out towards the end of the year as per PlanB’s stock-to-flow prediction of $288k, then this increasingly important on-chain metric will indicate how strong the market’s hands really are, and to what extent the market has bought into PlanB’s model and price targets. Clearly, at ~$60k, the general expectation is higher prices.

This second chart deserves a closer look, as this current trend of coins physically leaving exchanges is actually something that has not happened in such a way in Bitcoin’s entire history. For only the second time, there is a net negative transfer of coins to the exchange, the first time in 2017 was only fleeting. This time there is a sustained and major trend occurring which is a new market phenomenon and is worth exploring. In our opinion, the best explanation of this new trend is the fact that the market is rapidly maturing as real institutional players enter the market. Proper institutions will simply not rely on unregulated exchanges to custody their assets and will much prefer to remove their investments off exchange and store them independently. Slowly they are understanding the value proposition that Bitcoin is a sovereign store of value and unless you hold your own private keys then you simply do not own the value in Bitcoin. The credit risk of an unregulated exchange during a bull market is too high to justify holding assets with these counterparties, and no institutional investment committee would ever sign off on such a custody arrangement. We are encouraged by this new trend, as it shows that the educational journey that all crypto and specifically Bitcoin investors must go through to become long-term holders is slowing being made by these new institutional participants. This maturation of the knowledge base is subsequently reflected by coins leaving the exchange in greater sustained numbers than ever before in history.

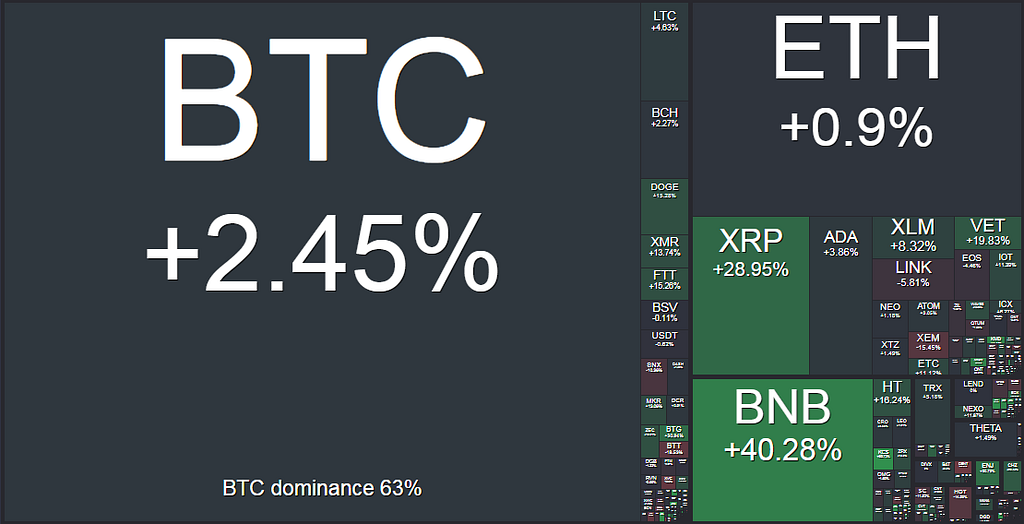

With BTC now entering its 6th week of +$50k consolidation, Alts have performed spectacularly well in recent weeks as traders cycle out of BTC and into low cap coins to play the alt volatility. BTC 3-month vol continues to compress to levels last seen in early November 2020, as traders take a breath to reflect before Wednesday’s massive Coinbase NASDAQ listing, currently estimated to be valued at $150 billion as per FTX’s pre-listing market. Month on month, XRP is now up ~210%, TRX is up ~160%, BNB ~110%, EOS ~70%, and THETA ~73%, and even the Korean Kimchi premium is back, trading at points last week as high as 20%. These frothy conditions are worrying ‘’toppish’’ signals, and combined with historically high funding rates on derivative contracts, make for a more neutral to bearish short-term outlook on the market and contradict much of the macro and on-chain analysis previously discussed.

So, all in all, a rather mixed bag of signals and analysis. We believe the key determining factor in how the market will play out in Q2 will be how the market digests Wednesday’s Coinbase direct listing. This is a major event, not just in crypto but in global finance in general and if crypto wasn’t firmly on Wall Street and Trade Finance’s mind yet, then come Wednesday, it 100% will be as coverage will be extensive. Coinbase is not alone in its pursuit of going public, and there will likely be further mega-market cap listings with Kraken, Gemini, eToro, Bitfury, and others making the same noise. It’s clear that companies and their shareholders are pushing to take advantage of the current bullish market conditions.

Medium to long term, we remain bullish for the industry, with Bitcoin leading the way. However, we approach the Coinbase listing with caution as a potential ‘’sell the news’’ event may very well play out with a downside move likely to be more aggressive than a move to the upside as it will catch the majority off guard. An aggressive post Coinbase dip will likely make for a superb entry point for a long-term position for those still looking for an entry. Post listing, we expect some increased volatility to return to Bitcoin.

—

Whilst short term price action this week remains unclear, notable comments last week from SEC commissioner Hester Pierce supports our long-term view that the crypto industry, despite the slow creep of regulation, is here to stay and certainly is passed (or passing) the point of ever being banned. Ray Dalio take note.

I don’t see how you could ban it…a government could say it’s not allowed here, but people would still be able to do it….so I think it would be a foolish thing for the government to try to do that

I think we were past that point of banning Bitcoin very early on because you’d have to shut down the internet. I don’t see how you could ban it — — Hester Pierce

Other noteworthy comments came from investing legend Peter Thiel who spoke rather cryptically about Bitcoin’s potential weaponization by China in its pursuit to destabilize USD hegemony

“I do wonder whether bitcoin should be thought of as a Chinese financial weapon against the U.S. It threatens fiat money, but it especially threatens the U.S. dollar.

..China’s long Bitcoin, perhaps from a geopolitical perspective, the U.S. should be asking some tougher questions about exactly how that works.”

Many journalists were quick to jump on this story and deduce that his comments were negative towards Bitcoin by promoting greater regulation but Thiel is very likely doing the exact opposite. He is very long Bitcoin and has been for years so has a vested interest in seeing Bitcoin price appreciate. He is also extremely well connected within US politics and especially the Republican party where he has donated significantly over the years. He is very aware that his comments will land within the political meeting rooms in Washington, and create a conversation that may well lead to the US taking a more prominent role in this potential new global reserve asset, before it’s too late. Peter Thiel has the politicians’ ear and he is using it to push Bitcoin up the agenda within US political circles that he can influence.

Smart move.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

https://medium.com/media/3b6b127891c5c8711ad105e61d6cc81f/href

5 weeks above $50k was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.