Having seen $1.5k grow to $100k, it’s time to double down and invest in my daughter’s financial future with conviction.

Originally posted on Jakeeswoodhouse.medium.com

This article was inspired by a letter I wrote in January 2021 to my 6-month-old daughter, Ruby Rose.

I am sharing this publicly in the hope it might assist other families as they plan for their long-term financial future.

Note:

- It is now April 2021, so the references and prices are old; however, the rationale remains valid.

- I have edited this version from the original I wrote, keeping some of the investment details private.

- I use Twitter to learn about Bitcoin, and you can follow me there. I would love to hear from you!

Dear Ruby,

First, I love you, and being a parent to you with your mum has been the happiest part of my life so far.

This is a letter that you might find boring, but it was necessary to organize my thoughts, which helped to make a major financial decision that will form part of your inheritance in the future.

I will discuss inheriting wealth, the problems with preserving it, and the solution that has only recently been invented: Bitcoin. Throughout, you will find links to information written by experts in the field whom I’ve researched and trust.

1. Unexpected Inheritance

On January 1st, 2009, my father, your Grandfather, died. He had an unexpected heart attack while working in the forest near our home, aged only 48 years.

This was one of the hardest times in my life, not only because I was grieving for my father, but also because a large financial responsibility was pushed onto me as the eldest son.

What were we going to do?

In 2010, we decided to sell our home, a property that had been in our family for three generations, leading to an unexpected portion of the inheritance being converted to fiat currency.

2. The Inflation Problem

On receipt of GBP (£) in cash by way of an inheritance, what do you do with it?

You want to keep it safe, accessible, and pass the value onto the next generation—but how?

- You could keep the GBP in a bank

- You could invest it

“Why not just keep it in the bank,” I hear you asking? “You can access it anytime, it’s safe, and you don’t need to take any risks with it!”

Well here’s the problem: GBP is losing its value over time due to inflation.

What is inflation?

Inflation is a currency’s decline in purchasing power over time.

As an example: if an apple costs £1 today, it’s possible that it could cost £2 for the same apple 1 year from today. This would effectively decrease the time value of money, as it would cost twice as much to purchase the same product in the future.

Inflation is caused by a number of different things, including changes in the demand and supply of goods and money, the latter of which is the major problem we face today when saving to preserve wealth.

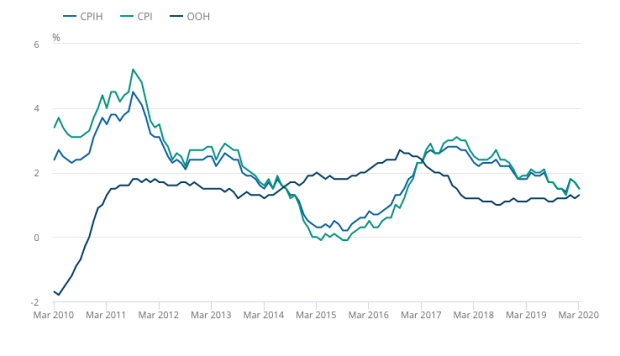

What has the UK’s inflation rate been?

The UK government uses the Consumer Price Index (CPI) as the “basket of goods” against which it measures inflation. Analysis of its long-term trends suggests that the UK’s inflation rate is not a problem and in line with the Bank Of England’s targets (i.e., the cost of living is increasing at the intended rate of approximately 2% annually).

What is the truth?

In my opinion, the government manipulates the CPI to help achieve its inflation targets, and therefore, the CPI does not reflect the real changes in prices.

For example, take “shrinkflation,” in which a chocolate bar continues to be sold for the same price of £1, but the manufacturer reduces its size over time. This means your £1 buys you less real value than before, and although the Office for National Statistics claims to factor this in, I am not so sure.

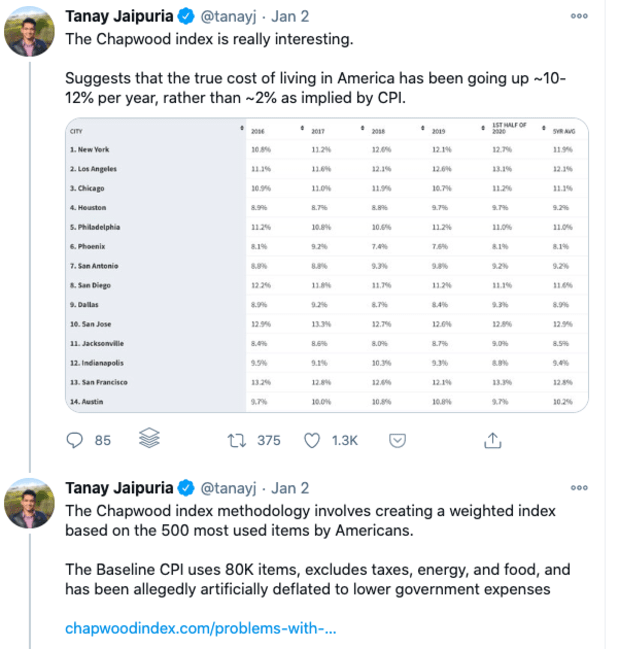

As a further example, Tanay Jaipura makes an interesting point by citing the Chapwood index.

Wow, 10%–12% inflation! But why?

The money supply.

The source of most of the inflation we see today is the monetary policies set by central banks, whether the Bank of England, the United States Federal Reserve, or the Royal Bank of Australia.

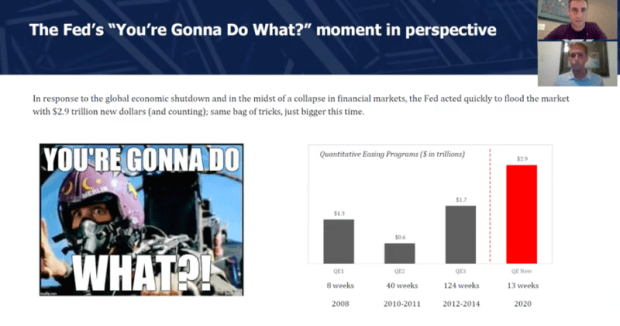

The last decade has seen huge quantitative easing (QE) programs, in which central banks create new money and increase the total money supply in circulation.

For example, if an economy had £100 in circulation, and the central bank created £10, then the money supply would increase by 10% to £110. This means that the purchasing power of any money you had has just been eroded by 10%.

Please see this excellent presentation by Parker Lewis that explains how the United States Federal Reserve has been “debasing” the USD. In March 2020, the Fed created $2.9 trillion in new money, and Parker predicts that this will happen again. He goes on to explain why bitcoin is exciting.

What’s next?

So, if I were to simply save GBP in the bank until it was time to pass it to you, your inheritance would have lost huge amounts of value in real terms: somewhere between 2% and 12% per year, according to our data.

What does this mean?

One has to invest.

3. Investment History

For 10 years, I’ve been working to preserve our wealth prudently for you, investing across different asset classes with a number of services.

Property

I made three real property investments: one is the house in which we now live, and the others are apartments. I leveraged the buy-to-let mortgage market, renovated one flat, and had tenants rent when possible.

Public Markets

I used wealth managers Ruffer and Tribe to invest in public markets, giving me exposure to financial products such as commodities, currencies, debt, equities, and funds.

Private Equity Angel

I joined an angel investment syndicate, Green Angel Syndicate, to invest in cleantech startups. I deployed a small amount of capital into multiple high-growth, high-potential technology companies.

I am happy to say that I’ve made more good decisions than bad, in that I’ve not lost all our money, but it has not all been smooth sailing.

4. Investment Problems

Investing is not easy, and I came across a number of problems:

Property

- Management is expensive. Rental agents charge 12% of each year’s rent to manage a tenancy, and unexpected operating expenses and vacancies happen, so yields are inconsistent.

- It is illiquid, with high transaction costs. They are not easy to buy or sell, and even when you can, there are very high transaction costs (approximately 10%–20% of the asset value can be lost to agents, lawyers, and taxes).

- Strong regulations. For example, the UK government now asks for 6 months’ notice to end a tenancy, so to sell your asset, you now have to wait out that period.

Public Markets

- Poor transparency of investment. Once annually, you are given a portfolio report by your wealth manager that includes a complex dataset on how your GBP was invested, which is hard to decipher.

- Misaligned fee structure. You have to pay an annual management fee of approximately 1%, regardless of performance, so there is no recompense for poor performance.

- Strong regulations. For example, certain assets can only be accessed by regulated entities, meaning that you have to use a wealth manager rather than invest personally.

Private Equity Angel

- Illiquid. It is only possible to make a positive return after the startup has a liquidity event, such as an acquisition or IPO.

- Long-term. Because of the amount of time required to build a profitable business, it is unlikely that you will get a return before 10 years, if not longer.

- High-risk. Investing into pre-revenue or pre-profitable businesses is by nature very risky, with a high chance that your investment will fail, and in that case, you receive no returns at all.

Remember: the objective of all this investing is to store value over time, which because of inflation rates means your investments need to gain more than 12% per year.

Akshay BD nicely summarizes the situation into which I have been forced:

5. Dad’s Bitcoin History

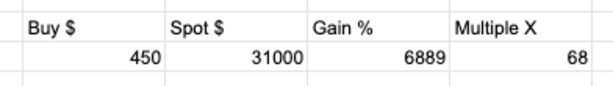

It’s about time we talk about Bitcoin. In December 2015, thanks to the influence of my friend Dan Burke, I purchased 13 bitcoin at approximately $450 per coin. Frankly, it was a gamble on an interesting new technology about which I knew very little.

Over time, I sold off 75%:

- October 2016 — to pay for a trip to Japan with your mum

- May 2017 —to pay for travels in South America with your mum

- July 2017 — out of fear that the Bitcoin Cash hard fork would negatively affect the price

The story you will likely find most amusing is of when I used my Bitcoin Cash to buy a 1980’s Mercedes SL350 from a rapper called “Black the Ripper.” I didn’t want the coins after the hard fork, so while browsing eBay in January 2018, I found a car advertisement stating that the owner was “willing to exchange for crypto.”

The car broke down on day 1, used to leak on your mum’s side, and was a nightmare for the 2 months we owned it.

At the time of writing, we still own 3 bitcoin, each valued at $31k.

(Editors note: bitcoin is now worth more than $60,000.)

The value of each bitcoin has gone up almost 7000%, or 70✕, in just 5 years.

These gains can be attributed partially to the inflation problem we’ve discussed, but also to the newfound demand for bitcoin as the technology matures.

Without a doubt, bitcoin is the best performing asset I have ever owned, and this experience has laid the foundation for my conviction in its future.

6. What Is Bitcoin?

I’ve just finished reading two excellent books, both of which were written since my first bitcoin purchase in 2015 and are representative of the number of intelligent people who have since been drawn into the space:

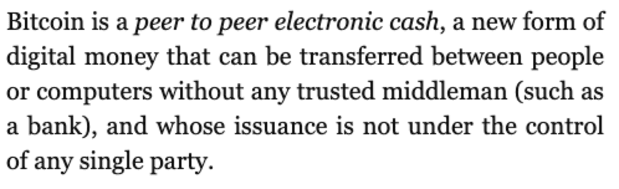

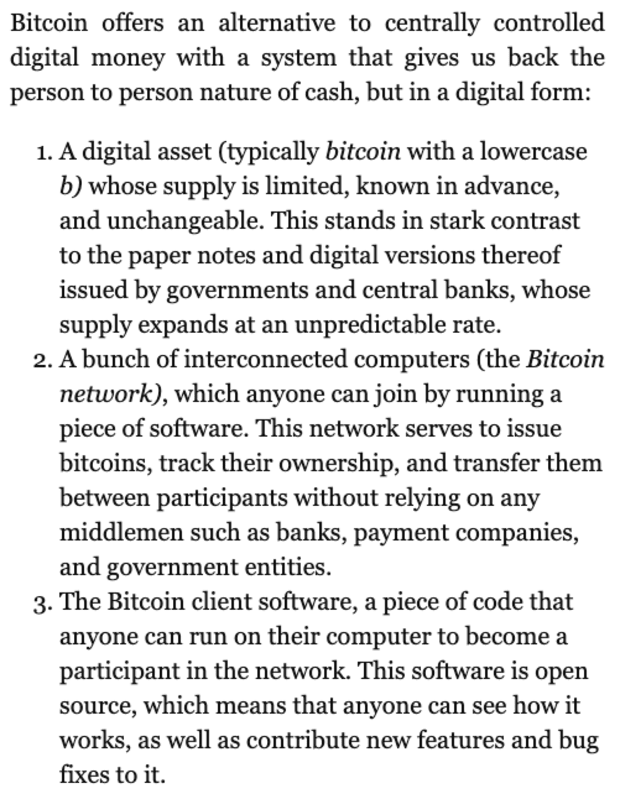

Inventing Bitcoin takes just a couple of hours to read and is a nice summary of the technology. Here are two excerpts from the book that explain what Bitcoin is:

The Bitcoin Standard is also one of the most mind-blowing books I’ve ever read, and it has been a critical basis for my newfound conviction in the asset. I love the history of money, its relevance in today’s macroeconomic scenario, and the theory of “hard money.”

If you’d like to hear a podcast that covers many of the questions most people have about Bitcoin, then have a listen to “Bitcoin Common Misconceptions” with Preston Pysh and Robert Breedlove. They cover many of the misgivings I initially had with Bitcoin, discussing the essence of money, how the technology works, and the lack of potential for government intervention.

I also recommend reading this article, “The Number Zero and Bitcoin” by Robert Breedlove. It provides an amazing historical recap of what money is and how it has evolved, including the revolutionary impact of the invention of zero in mathematics. The concept that people used to only be able to view the world in fractions and not move through zero into negative or make multiple subdivisions with a decimal point is fascinating. Breedlove frames Bitcoin as being as potentially revolutionary as the concept of zero.

7. Bitcoin’s Impact

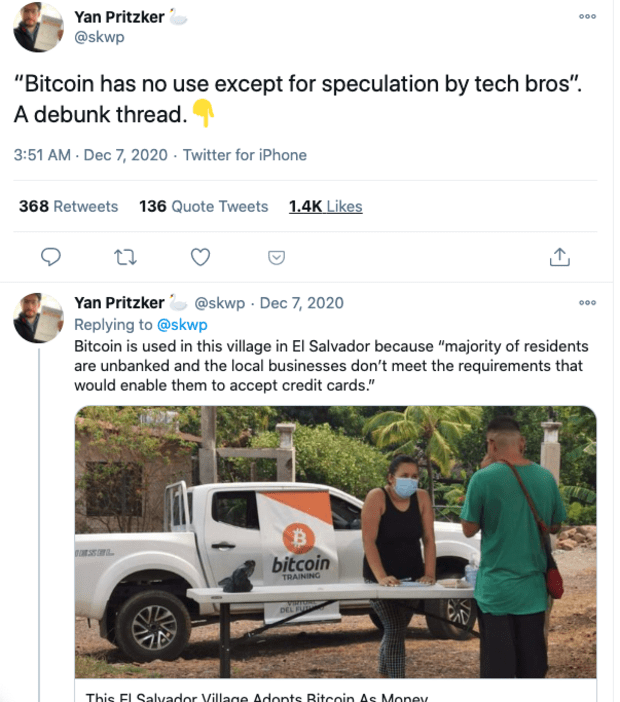

Bitcoin has the potential to have a huge positive social impact on people. Yan Pritzker made the interesting point that people who are unbanked in developing countries adopt Bitcoin, among other use cases.

Alex Gladstein made the case for Bitcoin as a human rights issue here:

The final slide summarizes his points nicely:

Parker Lewis is very concise in his analysis here. He contends that Bitcoin has far-reaching ramifications as far as reduction of the power that modern governments wield today, which I personally support:

8. Why Buy Bitcoin Now?

Since 2015, so much has changed in the Bitcoin space, which is very exciting.

- Stock-listed companies are buying bitcoin: This podcast featuring a conversation between Raoul Pal and Michael Saylor was what triggered my most recent dive down the Bitcoin rabbit hole. Specifically, I was attracted to the way Saylor spoke about how to preserve his company’s wealth for 100 years from now, which is the exact lens I have been using for the past 10 years, and the problem he was facing with regard to inflation. The upshot was that he discovered and researched Bitcoin, and then persuaded his US stock-listed company board to buy $450m worth of bitcoin from their cash reserves. (Wow!)

- Tech investors are openly buying bitcoin: I follow Shaan Puri, who has an excellent take on all things startups, and he is very open about the positive case for bitcoin and his personal asset allocations here:

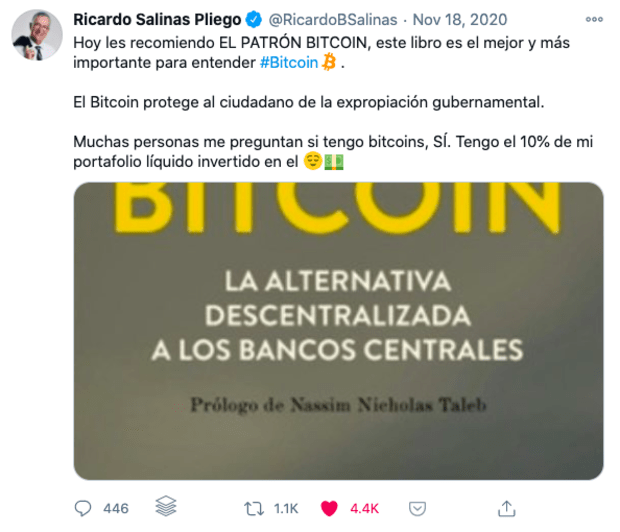

- High-net-worth money is buying bitcoin: Mexico’s 2nd-richest man recently announced that 10% of his liquid wealth is in bitcoin after having read The Bitcoin Standard.

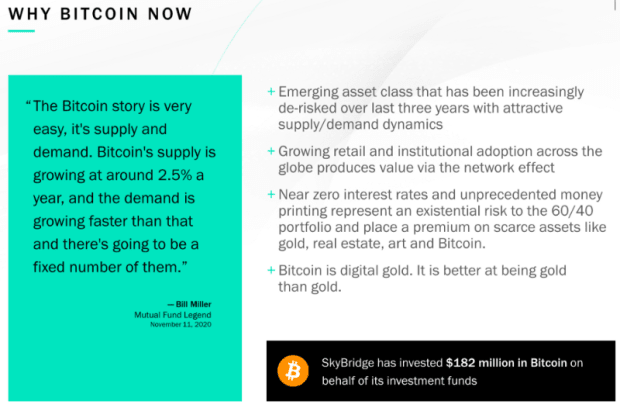

- Institutional investors are buying (more) bitcoin: This is an example of an institutional investor (Skybridge Capital) that has already invested in bitcoin raising funds for additional bitcoin investment.

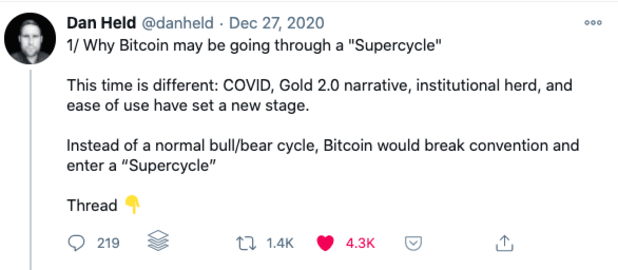

- Analysts are bullish: The Bitcoin Liferaft is another interesting piece of analysis from the extremely respected investor Raoul Pal. In addition, Dan Held explains nicely here and here why we are currently in a potential supercycle:

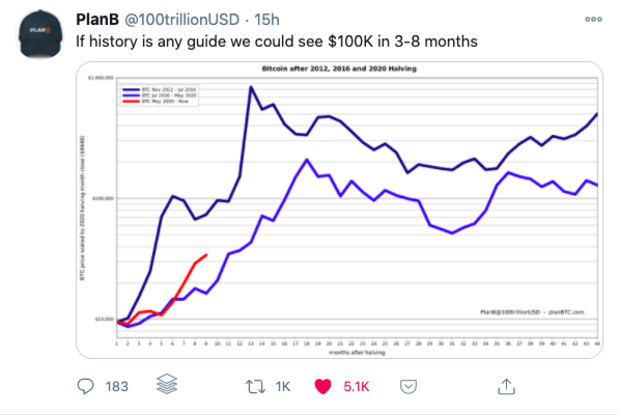

PlanB is another interesting analyst who is very bullish with his modeling here:

- Exchanges are bullish: The Winklevoss brothers, Tyler and Cameron, were very early adopters of bitcoin. They see it as the “money network,” which is interesting considering their involvement in the world’s most famous social network, Facebook. This is another podcast with Raoul Pal in which they talk of bitcoin at $20k being the “trade of the decade.” Their business, Gemini, sees itself as people’s portal into digital assets and also aims to be the custodian of their assets. Thus, they aim for their clients to avoid the need to self-custody their bitcoin. (Beware the mantra of “not your keys, not your coins,” which is what I am following)

Finally, I like Mark Moss and how simply he puts the use case for bitcoin here:

(Note to reader: I built a website with links to all the bitcoin research I have conducted, www.bitcoinwithjake.com. check it out for articles, podcasts, and videos!)

9. Features of holding bitcoin:

Bitcoin is going to be easier to manage than my previous investments because of some clear differences:

- Liquidity

- No management fees

- No operating expenses

- Transparency

10. How Do We Buy Bitcoin?

I use an exchange called CoinFloor to exchange my GBP for bitcoin and then send it digitally to my wallet.

In this podcast, the founder of Coinfloor, Obi, talks well about where we are on the adoption curve: very early. In particular, I am fond of his point about how many smart businesspeople are still wrapped up in their day-to-day roles and haven’t had a chance to study Bitcoin and learn of the benefits it could bring them.

11. How Do We Store Bitcoin?

Bitcoin allows you to take total control of your money, hence “self-custody,” meaning that we must look after it with the utmost care.

“Not your keys, not your coins.”

I researched and found Unchained Capital to help set up a multisig wallet, which stores our bitcoin.

This means there is no single point of failure, and our wealth is protected by multiple people with multiple keys in multiple places.

(Take note, potential thief! Even if you bash my door down, you can’t access our bitcoin, as the required keys are spread across multiple locations.)

12. The Risks

Of course, there are risks involved, which I pondered long and hard. Here are the main ones:

- Inheritance: In the case of my sudden death, like what happened to grandpa, what happens to our bitcoin? This was hands-down my greatest concern.

- Loss: What if you send your bitcoin to the wrong place? Or lose access somehow?

- Theft: What happens if someone hacks you? Or, what if someone pretends to be someone else and defrauds you?

Well, the answer to these first problems has been the multisig setup that Unchained Capital provides. I cannot recommend them strongly enough.

- Regulation: Governments like to control the money supply, even though they all claim that their central banks are independent, so there is likely to be some kind of regulatory pushback in the future. Unchained Capital will keep us fully up-to-date with regulatory changes, and I also advise you listen to the “Common Misconceptions” podcast with Robert Breedlove about why it’s impossible to actually shut down Bitcoin.

- Volatility: In Parker Lewis’ presentation, he explains why volatility will decrease over time. Because we are taking a long-term position, near-term volatility doesn’t bother me.

13. Going Long Bitcoin

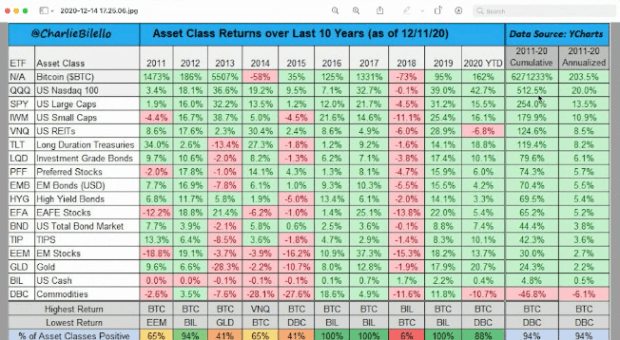

According to the table below, bitcoin has been the best performing asset of the last decade:

While angel investing, I came across a great thesis: “Invest in lines, not dots.”

In the context of startup investing, this means to watch for teams that progress extremely rapidly, and then supercharge your capital with them.

In my opinion, the progress bitcoin has made between 2015 and 2021 is the best “line” I have ever seen. Imagine it at 70✕ from here… If it performs how it has the last 5 years, that’s where it will be in 2026!

It’s time to double down, have conviction, and invest in your long-term financial security.

It is my belief that bitcoin is the best form of money humans have ever invented, represents the most effective store of value over time, and will outperform every other asset class.

So, here’s the plan: I am going to buy more bitcoin. Initially, this will involve simply buying with cash reserves, but I will also sell down our investment property until we ultimately end up with a 33%/33%/33% split between bitcoin/private equity/property.

14. Conclusion

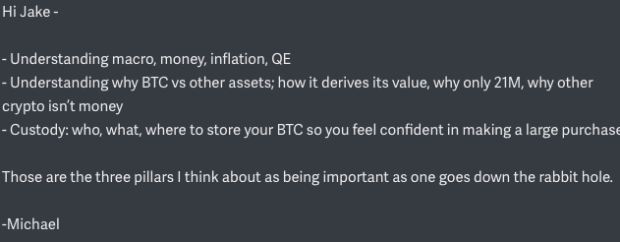

As Michael Tanguma of Unchained Capital explained, there are three key pillars to bitcoin belief:

I hope that this letter has not been as boring as I thought you might have found it! I wonder what will have happened once you read this!

Lots of love,

Dad

Thank you so much for getting all the way to the end. I hope you found this useful! If you have any questions, please follow me on Twitter.

Best,

Jake

This is a guest post by Jake Woodhouse. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine