Every once in a while, it’s necessary to dispel unfounded rumours of bitcoin’s imminent demise. One such rumour goes something like this: “a few people own the bitcoin supply, therefore it can be manipulated at will and you’re left holding the bags.”

Aside from the fact that bitcoin is a maturing asset, this statement is plainly false.

Also, why would you sell the currency of the future for the currency of the past?

Let’s dig in.

Bitcoin Supply Distribution remains Decentralised

A Bloomberg report in late 2020 stated that about “2 % of accounts control 95% of all bitcoin.” And indeed, raw data on bitinfocharts.com suggests a sizeable concentration of bitcoin in the network when taken at face value.

However, the issue with this data point is that the btc distribution across network addresses does not accurately reflect the concentration of bitcoin.

As such, Glassnode introduced an ‘entity’ which aggregates addresses that belong to one group or person with each other to compile a more accurate account of bitcoin supply distribution.

To do this, two concepts are key:

- Bitcoin addresses, which can hold funds from more than one individual (e.g. exchange addresses).

- One single entity, which can own and control multiple bitcoin addresses holding BTC.

An in-depth analysis from Glassnode reiterates in various ways that bitcoin remains decentralised when entities are taken into considering, and that the current circulating supply is also distributed among smaller entities.

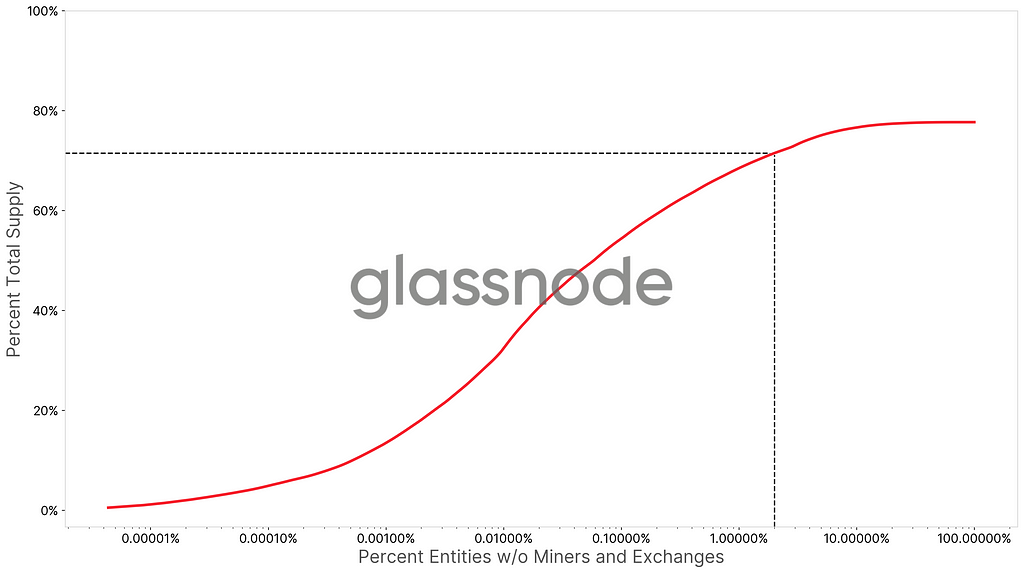

The above estimate measures the percentage of the bitcoin supply controlled by network entities (excluding miners and exchanges). Per the chart, about 2% of network entities control 71.5% of all bitcoin, which is notably different from the ‘95% supply ownership’ that Bloomberg reports.

By compiling the number of entities holding bitcoin, excluding custodian exchanges and miner entities, the bitcoin supply distribution is as such:

- Miners — 9.7% (1.91mn)

- Exchanges — 12.7% (2.36mn)

- Whales >5k btc -13.3% (2.47mn)

- Users 1k-5k btc — 18.4% (3.42mn)

- Users 500–1k btc — 6.6% (1.23mn)

- Users 100–500 btc — 11.6% (2.20mn)

- Users 50–100 btc — 4.7% (0.87mn)

- Users 10–50 btc — 8.9% (1.66mn)

- Users 1–10 btc — 9% (1.68mn)

- Users <1 btc — 4.9% (0.90mn)

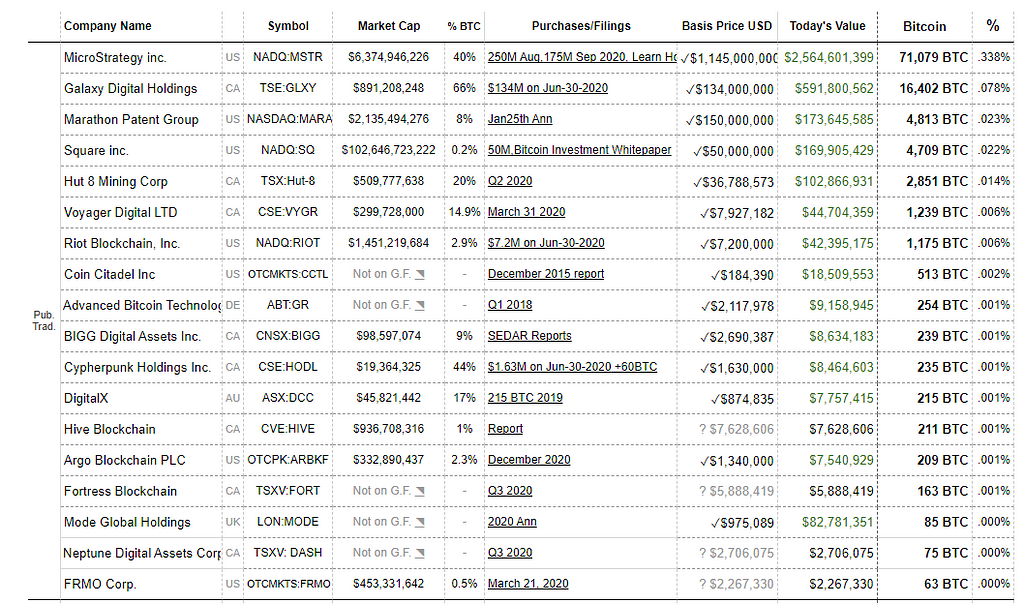

On the high net worth end of the spectrum (>5k), the biggest entities control 31% of all bitcoin supply. In all probability, these players are institutions, funds, trading desks, and high net worth individuals, in addition, to publicly traded companies listed on bitcointreasuries.org.

On the other hand, smaller entities account for 23% of the supply, which is to say that retail investors make up a sizeable chunk of the distribution, alongside many bitcoin ‘OG’s’ that are in the whale category who share the prevailing bitcoin ‘hodl’ sentiment.

On top of this data, we must also take into account various other factors which significantly colour trending market dynamics.

- For instance, custodians such as Grayscale, which has around (650k bitcoin), would shift some of the distribution towards smaller players — though notably larger than your average retail investor.

- Lost coins account for around 20% of the total bitcoin supply. If factored in, these would most likely add to a more widespread distribution curve.

- Additionally, an emerging DeFi phenomenon, which includes Wrapped BTC (i.e., bitcoin on the ethereum network), represents over 115k in BTC, which if included would increase bitcoin dispersion, owing to the fact that these accounts represent a large pool of investors.

- Finally, exchanges account for about 130 million bitcoin. It’s safe to assume that the overwhelming majority of these are custodied by smaller entities, which would, in turn, skew distribution more towards retailers.

Clearly (and to everyone’s relief), the bitcoin network remains decentralised any which way you look at it.

Get this newsletter on release! Join the mailing list.

Technically speaking

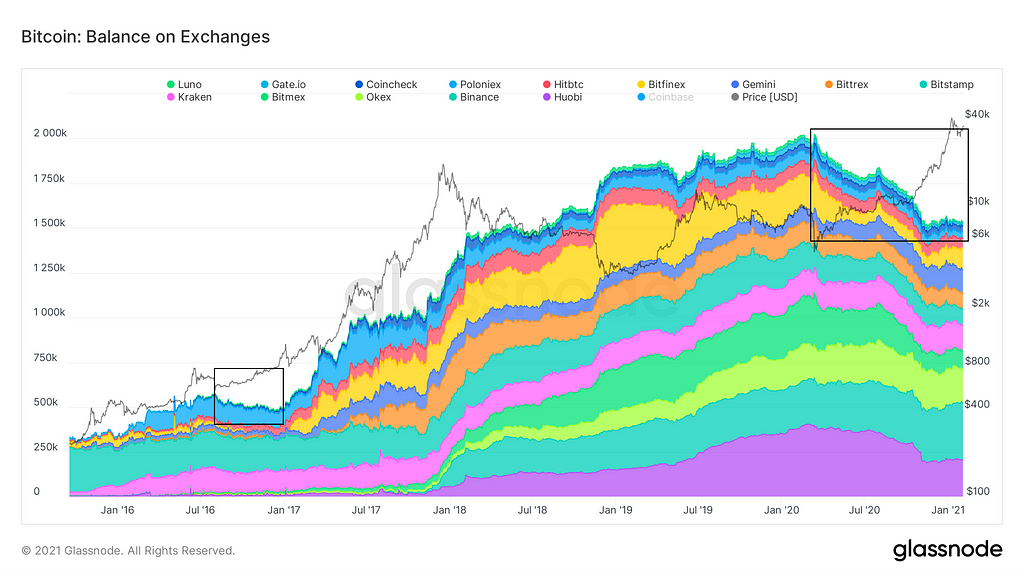

Echoes from the past: bitcoin balance on exchanges nears an inflection point

While each market cycle for every asset is different, bitcoin might rhyme more than usual due to coded predictability. Since supply distribution is known, there is less room for interpretation, which lends credibility to historical precedent.

Join the Telegram channel for live updates!

Follow me onGab and my social portals below.

Read More: DEX Trading Takes off as Robinhood Defrauds its Own Customers

You can also support me in bitcoin!

BTC address: 3EydsEYpjHn68axKnCUqBB7EbqcxrEjamr

Originally published at https://mailchi.mp.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

https://medium.com/media/3b6b127891c5c8711ad105e61d6cc81f/href

Echoes From the Past: BTC Balance on Exchanges Nears a Major Inflection Point was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.