Ripple Scores Small Win Against SEC, Crypto Community Welcomes News — Analysis, 12 Apr

The cryptocurrency market has been seeing very positive weeks from a fundamental point of view for a while now. State Street, the second-oldest bank in the United States with over $3 trillion in assets under management, is going to offer trading crypto to its clients later this year, according to Financial Times.

Meanwhile, Hong Kong-based technology firm Meitu revealed that it had reached its target to invest $100 million in crypto assets for its treasury department.

However, the biggest news was Ripple’s small win against the US Securities and Exchange Commission (SEC). Last Friday, the company managed to stop the SEC from publishing the financial records of its CEOs.

The crypto community welcomed the news. Many cryptocurrency enthusiasts now expect the SEC to define XRP similarly to Bitcoin and Ethereum and close the lawsuit against Ripple sooner or later. Although not all cryptocurrency enthusiasts are XRP proponents, a potential Ripple win against the SEC will be interpreted as an initial signal that the US regulator may continue to keep its loose stance on cryptocurrencies and even become crypto-friendly.

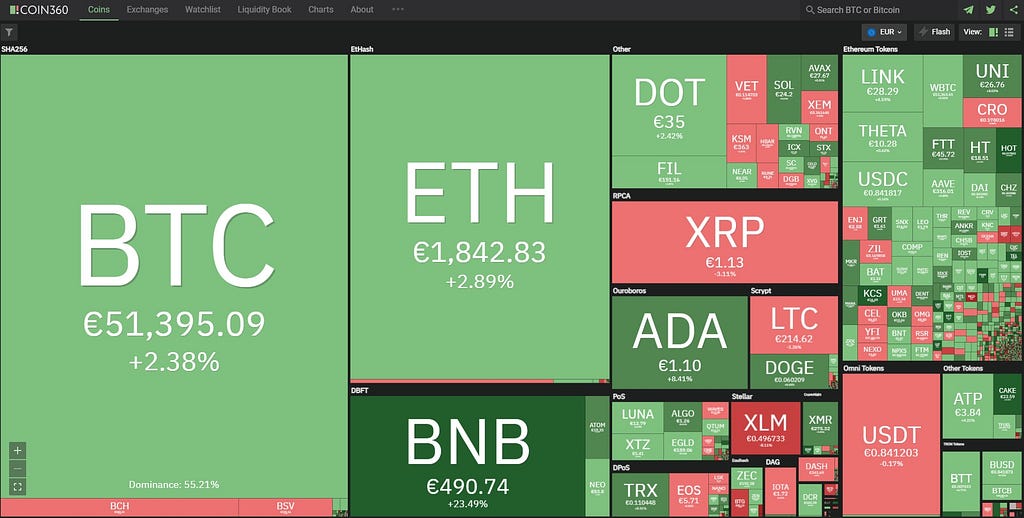

Thanks to the positive news during the weekend, the crypto market gained traction. The positive sentiment remains in place during the opening of the Monday market. At the time of writing, according to Coin360.com, one Bitcoin costs €51,395.09 (+2.38%), one Ethereum — €1,842.83 (+2.89%), and one LINK — €28.29 (+4.59%):

Now, let us analyze the price charts of the leading cryptocurrencies in the noteworthy time frames.

BTC/EUR

In the daily time frame (1D), BTC/EUR has formed an Ascending Triangle — a typical trend continuation pattern:

As can be seen from the chart, BTC/EUR is testing the upper line of the triangle at the moment.

It is worth highlighting that the price is receiving additional support from the trend line and 30-day Moving Average. That is why it is highly probable that a breakout will occur and the uptrend will resume.

ETH/EUR

In our previous analysis of Ethereum, we outlined that, in the 4-hour chart (4H), ETH/EUR had already exited the Symmetrical Triangle (a typical trend continuation pattern):

We also explained a potential scenario for the price developments of ETH/EUR and how to enter the market. That scenario matches Scenario 1 (S1) in our chart.

However, today we want to point out another potential scenario as well. It is Scenario 2 (S2) in our chart. In this scenario, after the recent local high, a deeper price pullback bringing the price down to the upper line of the triangle may not happen. It is because the Ethereum price declined slightly after forming a local high outside the triangle and almost reached the 30-day Moving Average. After that, the price has started to increase again. Now, ETH/EUR is at the level of the previous local high. Very soon the price may surpass the local high, and many conservative traders will start opening long positions. Hence, Scenario 2 is the most probable one.

LINK/EUR

LINK/EUR continues to consolidate within the broad range in the daily time frame (1D):

Right now, the price chart is in the upper bound of the range. We will outline two potential scenarios. Scenario 1 (S1) is the bullish one. In this scenario, a breakout takes place, and the price chart exits the consolidation range. In this case, many conservative traders will enter the market by opening long positions.

The second scenario is Scenario 2 (S2). It is the neutral one. This scenario is very similar to the one we already explained in our previous analysis, with the only difference that we do not expect the price to drop to the lower bound of the range. Instead, it will receive support at the 30-day Moving Average (MA 30) and 90-day Moving Average (MA 90).

We think that both scenarios are equally likely.

Stay updated on everything Bitcoin-related with Bitvalex. Bitvalex is a licensed digital wallet and cryptocurrency exchange; learn more about us and blockchain technology and sign up to use our services.

The analysis is purely informational and does not constitute investment, financial, trading, or any other sort of advice and you should not treat any of Bitvalex’s content as such. Bitvalex does not recommend that any cryptocurrency should be bought, sold, or held by you. You are solely responsible to conduct your own due diligence and consult an advisor before making any investment decisions.

Originally published at https://bitvalex.com.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

https://medium.com/media/3b6b127891c5c8711ad105e61d6cc81f/href

Ripple Scores Small Win Against SEC, Crypto Community Welcomes News — Analysis, 12 Apr was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.