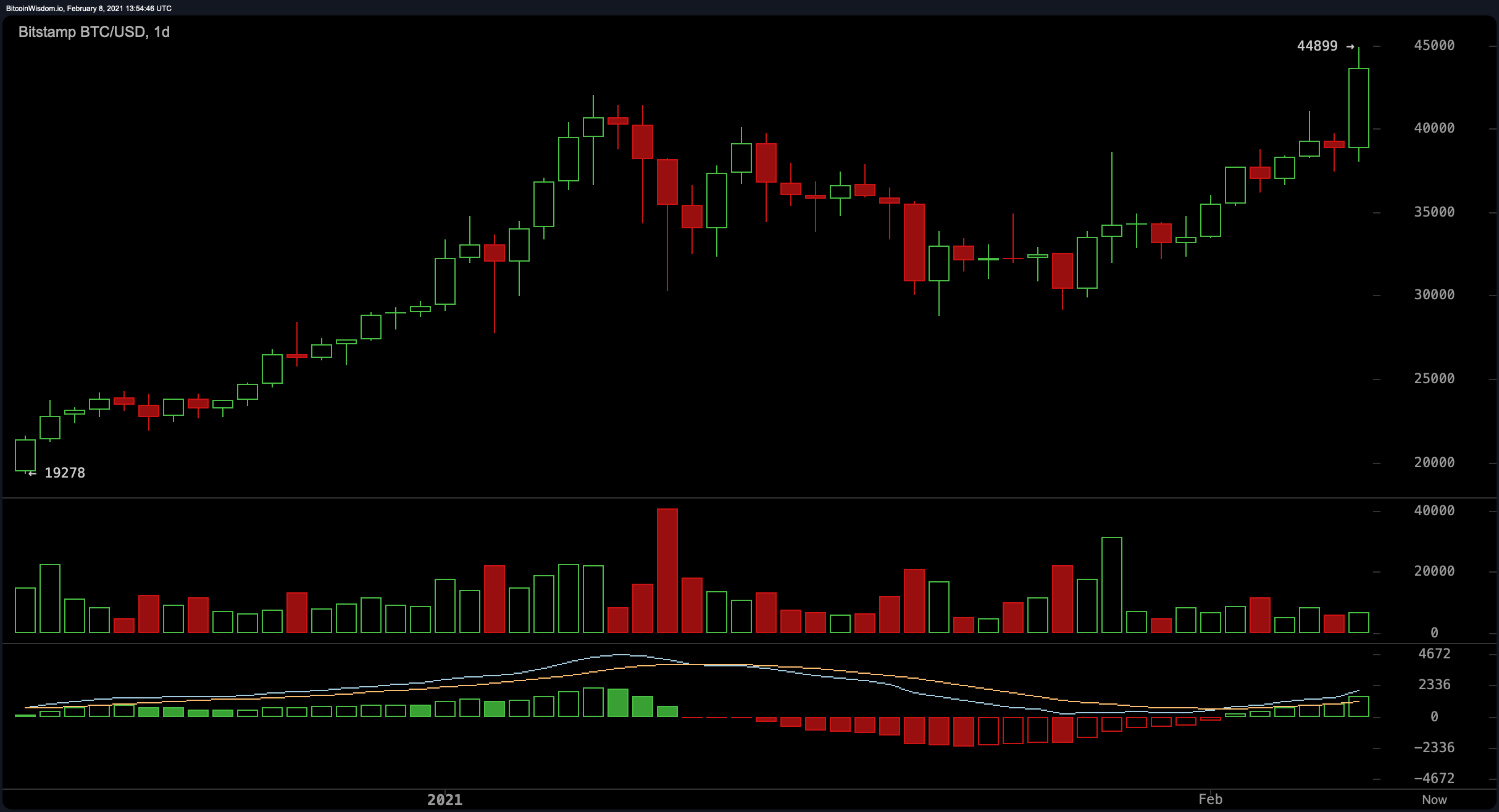

The publicly listed firm Tesla has announced in a Securities and Exchange Commission (SEC) Form 10-k filing that the company has purchased $1.5 billion worth of bitcoin. When the news broke, the price of the leading crypto asset jumped well over 15%, touching a new all-time price high at $44,899 per coin.

Tesla, the American electric vehicle and clean energy company based in Palo Alto, California has revealed the company has invested in bitcoin (BTC). This is following the great number of dogecoin (DOGE) tweets stemming from the Tesla founder Elon Musk during the last two weeks.

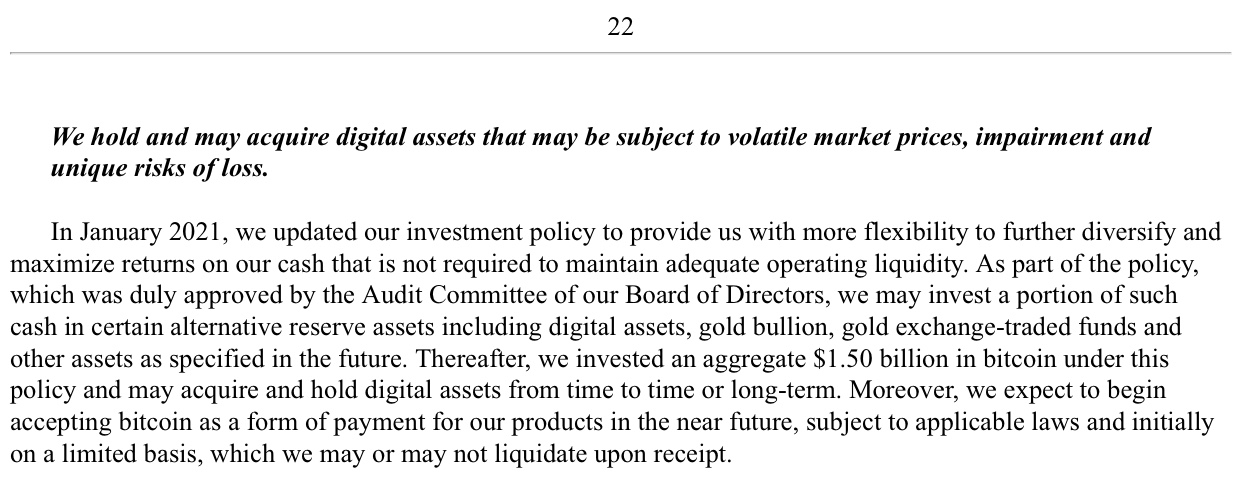

The announcement was found in a SEC Form 10-k filing which says the firm may “hold and may acquire digital assets that may be subject to volatile market prices, impairment and unique risks of loss.”

“In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity,” the Tesla 10-k SEC filing continues.

“As part of the policy, which was duly approved by the Audit Committee of our Board of Directors, we may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future. Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy and may acquire and hold digital assets from time to time or long-term,” the SEC filing notes.

Additionally, Tesla detailed in the filing that the company will begin to accept bitcoin (BTC) as a form of payment for Tesla products.

“Moreover, we expect to begin accepting bitcoin as a form of payment for our products in the near future, subject to applicable laws and initially on a limited basis, which we may or may not liquidate upon receipt,” Tesla’s filing details.

Of course, the crypto community was extremely pleased to hear that Tesla was now a bitcoin holder and keeps BTC on its balance sheet. The price of bitcoin (BTC) literally went up in value roughly $4,000 since the Tesla news started going viral.

Significantly large BTC short positions were immediately liquidated at $42,700 per unit. After the Digital Currency Group founder, Barry Silbert, tweeted about the competition between Microstrategy and Grayscale, and Silbert welcomed Elon Musk into the race.

“Player 3 has entered the race. Good luck, Elon Musk,” Silbert tweeted. At the time of publication, bitcoin (BTC) is exchanging hands for prices between $43k and $44k.

What do you think about Tesla adding $1.5 billion to its balance sheet? Let us know what you think about this subject in the comments section below.