Whether it’s a base-layer solution or a new financial product, it seems like every week, there’s a new reason to be fundamentally excited for bitcoin and ethereum.

And when the charts speak to these fundamental narratives, the possibilities become even more attractive.

Let’s dig in.

Ethereum Financial products come to market

Last week, Ethereum was the subject of much online discussion — a lot of which was a salty take on the platform’s future.

At the same time, Ethereum financial products are launching just as a major scaling solution that could increase Ethereum’s throughput by 100x is about to hit the platform’s mainnet this month.

Indeed, just one month after launching a Bitcoin Exchange Traded Product on the Swiss SIX exchange, CoinShares released a physically-backed exchange-traded product following the performance of the second biggest cryptocurrency — Ethereum.

Headquartered in London, CoinShares is a crypto-oriented financial manager with over $4 billion AUM. The ETHE ticker has a base fee of 1.25%, and this premium is lower than current offerings on the market.

Meanwhile, CI Global Asset Management revealed that it has filed a preliminary prospectus for a CI Galaxy Ethereum Exchange Traded Fund (ETF), which is set to be the world’s first Ethereum ETF on the market.

The well known crypto bull, Mike Novogratz explained that Ethereum is the number one candidate to build the base layer of Web 3.0, saying: “Ether is a growth asset that provides investors exposure to the explosion of decentralized applications.”

Technically speaking

Is the correction over?

Both bitcoin and ethereum continued their price revisions since our description of the technical picture in the last newsletter.

Bitcoin flipped $50,000 into resistance and traversed lower through the weekend, closing the month of February just over $45,300 ( bitfinex).

But as this happened, selling pressure subsided, and lower time-frames revealed a potential reversal signal.

As described above, bitcoin set lower-lows while printing a bullishly diverging Relative Strength Index (RSI). The king crypto also came within an arms length of its parabola before buyers stepped back in.

Throughout the sell-off, volumes across exchanges declined, suggesting that sell-side pressure was not indicative of a high-time-frame trend reversal.

While the bulk of the sell-off appears to be over, being mindful of potential downside targets (however unlikely) is useful. The 20-weekly EMA stands at $33,050 at the time of writing, up 5.10% week-on-week.

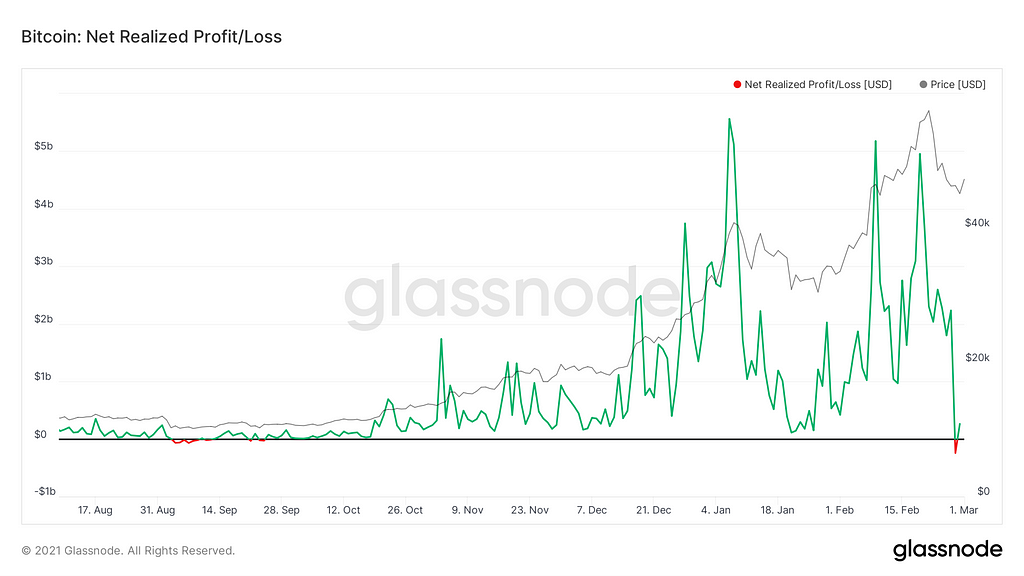

Coins exchange hands at a loss

During the sell-off, coins were moved at a net realised loss for the first time in 5 months. The steep correction can only be described as market-wide panic, not dissimilar to bitcoin’s performance in January (but slightly more dramatic).

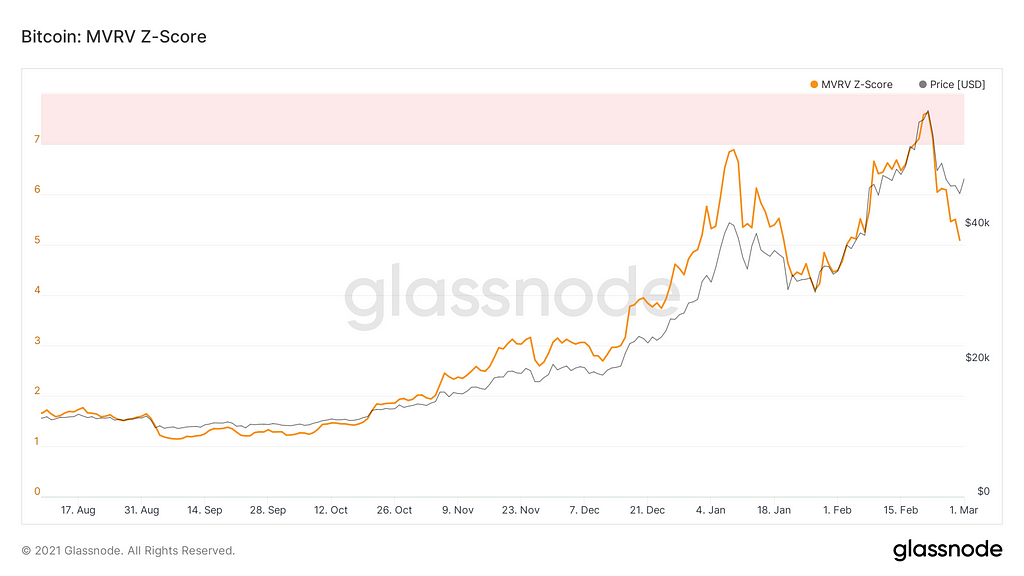

Bitcoin is not overvalued

While some might point to a weekly chart and think it’s ‘overvalued,’ on-chain data reveals bitcoin could (and probably will) trend higher. The MVRV Z-score assesses bitcoin’s fair value status and is defined as the ratio between the difference of market cap and realised cap and the standard deviation of market cap. The indicator has historically indicated short-term and long-term market tops — and is useful for clawing overzealous buyers back to reality.

The bottom line

As a trader, you’re forced to contend with whatever the data indicates.

As someone who recognises just how broken the financial system is, you’re forced to understand that despite our efforts to properly price bitcoin, the reality is that its value is unknown — therefore, the upper-bounds for bitcoin’s price are also unknown.

We exist in a legacy financial system that makes a real free market impossible. Whether it’s ancient Rome or events as recent as the Weimar republic’s hyper-inflationary catastrophe (or anything in between), this state of affairs has been the case for the entirety of human history, and it’s now coming to an end.

The question is; how can one adequately value something that has never existed using outdated tools?

This is why bitcoin’s value proposition is unknown; it escapes the confines of what we consider normal, which is what all great technology does.

At the same time, a base-layer for web 3.0 is being built on ethereum — which was designed with smart contracts in mind. If bitcoin is the base layer of money, then ethereum is the base-layer for borderless applications.

The next question that follows is: how does one value the protocol layer for web 3.0? And if you could own a piece of Html, would you?

The bottom line is, markets do not know how to value novelty, and volatility is an expression of this uncertainty.

Catch you next time.

Join the Telegram channel for live updates!

Follow me on Gab and my social portals below.

Read More: Scaling Coming To Ethereum In March with Optimism Mainnet Launch

You can also support me in Bitcoin!

BTC address: 3EydsEYpjHn68axKnCUqBB7EbqcxrEjamr

Best regards,

Christopher Attard

Founder of Chris on Crypto

Contributor to www.cityam.com

Connect directly on: Telegram

Originally published at https://mailchi.mp.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

https://medium.com/media/3b6b127891c5c8711ad105e61d6cc81f/href

Three Reasons Why The Bitcoin Correction Could be Over was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.