What happened? The ship sank? Out of nowhere prices fell? We know that you are the main ones asking what is going on in the head of each one of you.

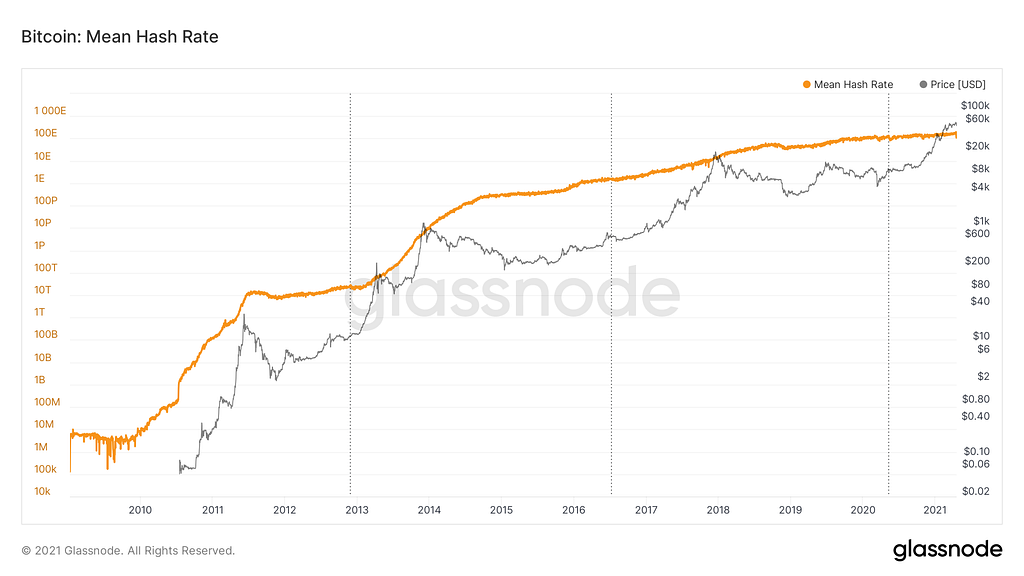

But do not worry, according to the latest news, what caused the fall in the prices of most cryptocurrencies was due to an interruption of the electricity supply in the province of Xinjiang in China, which began on Thursday, April 15 due to security inspections, and with it, the Bitcoin hash rate decreased this Saturday by 40% to levels below 110 EH/s.

According to the report, mining activity in China represents 65% of the total Bitcoin hash rate, while the Xinjiang province percentage is at 20% and 36% of the total Bitcoin hash rate, according to the Cambridge University Mining Map, in its last update April 2020.

Something Contradictory

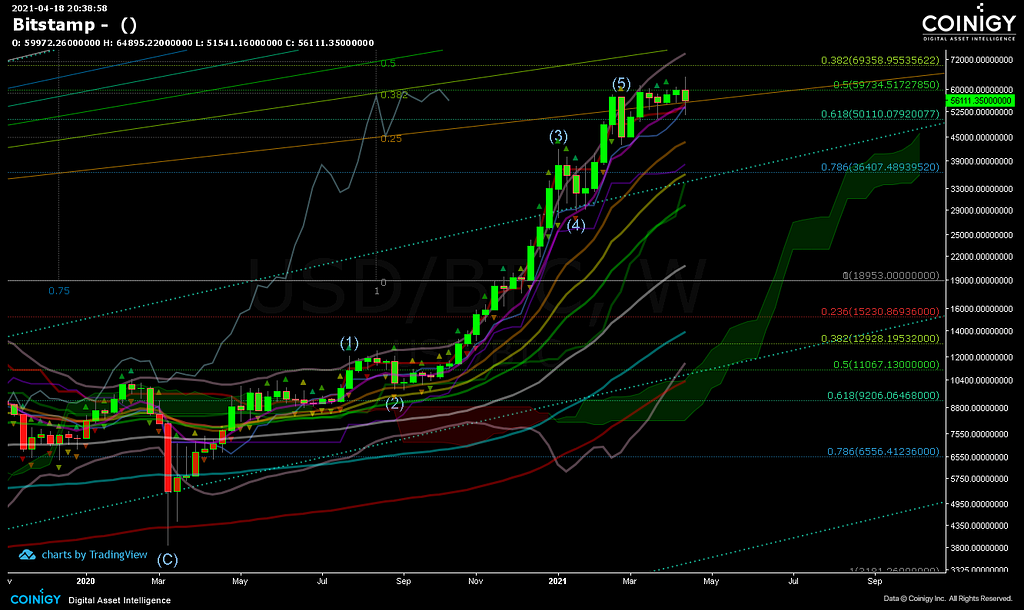

To start the week, it is important that you know that within the weekly Bitcoin chart, there was a crossover of the MACD moving averages. This movement triggered the alerts of the big players in the market, which initiated the closing of multiple long positions.

To date, and according to statistical data, 1,031,650 traders were liquidated. The largest single liquidation order happened on Binance-BTC value with $ 68.73M. What a goat game!

Market sentiment is fundamentally optimistic, but something always happens that causes many people to lose money. On our part, we hope that you did not fall on that list.

Anyway, it should be noted that when this market report was made, Bitcoin was making its weekly closing with a not completely red candle, but still with the bullish pennant figure and at approximately 56254.64.

With this latest analysis, Bitcoin is expected to remain lateralized weekly in the region of 59734.51 and 50k, with well-defined support due to the crossing of the Tenkan-Sen, CKSW1, EMA9W1 indicators and above a conversion point of 53k. Exact point where the price made its rapid recovery.

Weekly RSI breaking out of the 70 points and losing support, along with the imminent drop in trading volumes. With all this, it is good to be ensuring profits and wait for a recovery in the market.

Reported Accumulation

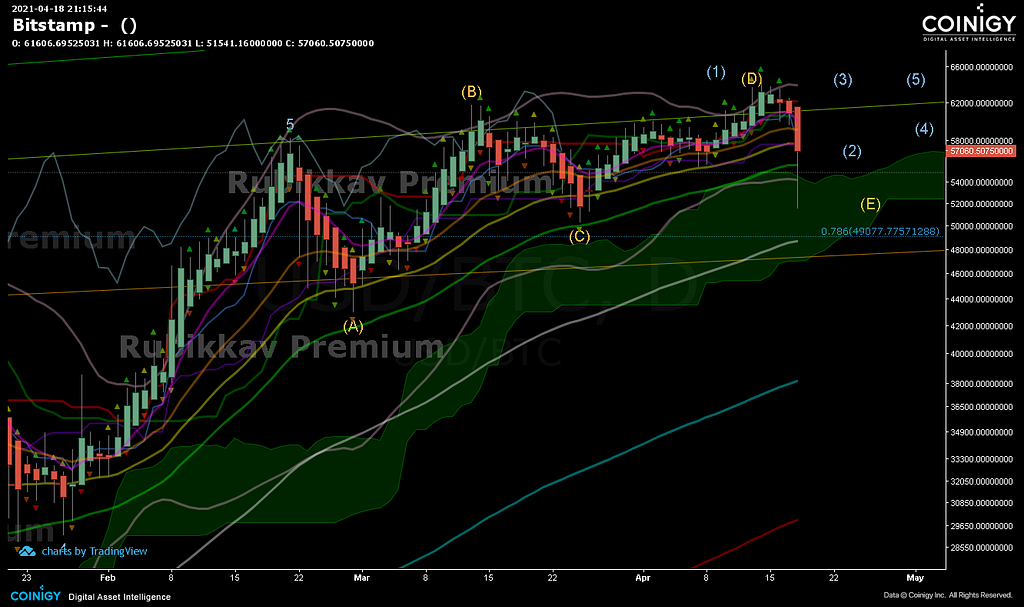

To calm the panic, we have to remember that in past analysis, we had already said that Bitcoin would enter an accumulation phase ABCDE within the daily chart and that very soon, we would see a new phase or cycle of Elliot wave 12345.

If you have followed our personal logic, this is exactly what is happening. Bitcoin is in that ABCDE accumulation phase. That price decline, initiated by the false break of the 60k resistance, and the negative news from China was what created the E wave, which almost reached the main support of the 0.7 fibo and at exactly 49077.75.

Below that parameter, there was a breakout of the EMA50D1 at 55830.41 and the lower Bollinger band at 54k. Parameter that can represent the next few days a good short-term investment interest but with low sentiment in the medium and long term.

Last Words

Don’t be discouraged. We are not saying goodbye at all. We simply want to teach you something based on the facts shown here.

One first thing we want you to know is that the main reason many traders lose money is not reading our things. So, follow our logic, sit down and read what we are sending you weekly. Our goal is that you earn the maximum but responsibly.

The second game should remind you that whenever there is a drop in the prices of cryptocurrencies, the purchase alerts immediately go off, and the prices recover quickly in an area controlled by the big players who never want to buy expensive.

The third fan society already tells many that it is easy to lose money doing exhausting day traders and with a lot of leverage. With this, and if you have noticed, we have lately sent opportunities without leverage, but with good profits that only need the patience factor.

As a last thought, we have already learned the lesson that holding many altcoins can be disastrous for our portfolio. So always remember to enter a trade, take profits when indicated, make daily, weekly, and monthly closings, and then be happy. But above all, never forget to place a stop loss.

Visit our official page https://rubikkav.com/.

Join to our community on Telegram https://t.me/rubikkavcommunity.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

https://medium.com/media/3b6b127891c5c8711ad105e61d6cc81f/href

Weekly Main Aspects That You Should Know About Bitcoin Cryptocurrency Market was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.