Remember the parabolic rise of bitcoin (BTC) from $1000 to $17000. For cryptocurrency stakeholders, investors, and crypto exchanges alike, 2017 was a phenomenal year because it was not just limited to bitcoin, the positive momentum replicated with Ethereum, ETH ($10 to $788), XRP ($.006 to $.257), and other cryptocurrencies. For several new cryptocurrencies like BNB, it was the debut year.

It has been 4 years since then. In this period, cryptos have also braved the historic pandemic but emerged out of the worst financial scenarios with flying colors. Here is an analysis of what kept cryptos momentum on and what’s the way forward for investors and other stakeholders.

Cryptos are not a safe refuge for black money

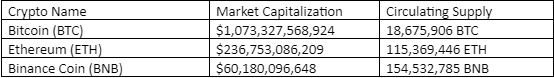

The popularity and acceptance of cryptocurrencies have defied the illegal tag. Much before the heydays of 2017, when bitcoin or other crypto traders were making unexpected gains and becoming prosperous, this theory was propounded as many, particularly those who abstained from investing due to fear or mistrust, were unable to digest the success of their counterparts. It was true to some extent but not the complete truth. Bitcoin has completed almost more than a decade, Ripple is also close to it, and there are many that have completed almost five years or more. In the 2017 bull run phase, the myth that cryptos are only for illegal trades got busted, and by 2021, it has become almost mainstream trading. The growing market capitalization worth and circulating supply prove the transition right.

With bitcoin surpassing the value of fiat currency or even outperforming value appreciation, its use like money to buy a commodity shall not surprise. Now, the use type — legal or illegal — depends upon its owners. Fraudsters like drug traffickers were always there ever since the origin of fiat, and they exist even in this crypto age. It’s the onus of the government, regulator, and law enforcement agency to keep a check on its misuse. Perhaps, the decentralized blockchain ledger, the fascinating technology behind cryptos, has an incredible recording and monitoring mechanism that can be utilized to stop all illegal transactions.

Crypto are for public good

Nobody owns a cryptocurrency network. It is controlled by users in the network. This inherent beauty of the decentralized blockchain behind the cryptos has become a thing of public attention. Bitcoin can only work correctly with a complete consensus among all nodes. Even governments and institutions like the IRS (Internal Revenue Service) can’t afford to ignore this property anymore, and many have given acceptance to the blockchain software, if not to the crypto trading. The European Commission is encouraging its use to reduce bureaucracy, enhance the efficiency of administrative processes and increase the level of trust in public record-keeping, and many are mulling over innovative use cases of blockchain.

Cryptos for buying real-world things

The application of crypto as a payment instrument is a huge leap. Today, you can order pizza, book a table at restaurants, buy apartments, pay your lawyer’s fees and charges, and do more. Using a search engine like Spendabit (homepage shown above), you can search through millions of products, all available for purchase with bitcoins. Use the search option to find your item and get the list of products displayed from listed vendors.

2017 bull run was not a coincidence

The progressive trend of bitcoin and other cryptocurrencies over the past few years is an indication that what happened in 2017 was not a coincidence. The current bull run of 2021 is even stronger than that, and it comes at a time when Covid-19 has badly affected the economies everywhere.

Now crypto has gained the support of institutional investors and people from the elite class who are known for their investment skills. Harvard University, Stanford University, Dartmouth College, Massachusetts Institute of Technology, and the University of North Carolina have made investments into at least one cryptocurrency fund. The launch of Bakkt, a futures exchange by the holding company of NY Stock Exchange, and ventures of CME Group and Cboe Global Markets in the field are encouraging incidents towards the acceptance of cryptos, claims the Economic Times. Elon Musk’s Tesla’s investment in bitcoin is an open truth.

The developments happening approve that cryptos soon would be a mainstream asset. What do you think? Do let us know in the comment section.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

https://medium.com/media/3b6b127891c5c8711ad105e61d6cc81f/href

What Made Crypto So Successful Since the Last Bull Run in 2017? was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.