During the week of January 24 to 31, 2021, the market remains with constant ups and downs. More than 40% of altcoins show a downward trend; while a large majority have experienced slight growth, and some exceed 200%, according to criptonoticias.

The most appreciated cryptocurrencies in these seven days are led by Dogecoin (DOGE), whose value appreciated substantially after the purchase action coordinated by the WallStreetBets group of GameStop shares. Something similar happened with Ripple’s XRP, which ranks second despite Ripple Labs’ legal troubles. It is followed by Siacoin (SC), ranked third amid preparations for its next hard fork.

The list of crypto assets for the week is completed by Decred (DCR), which released a new version of its software; and Stellar (XLM), which invests $ 5 million in the Wyre Business Fund, a blockchain payments company.

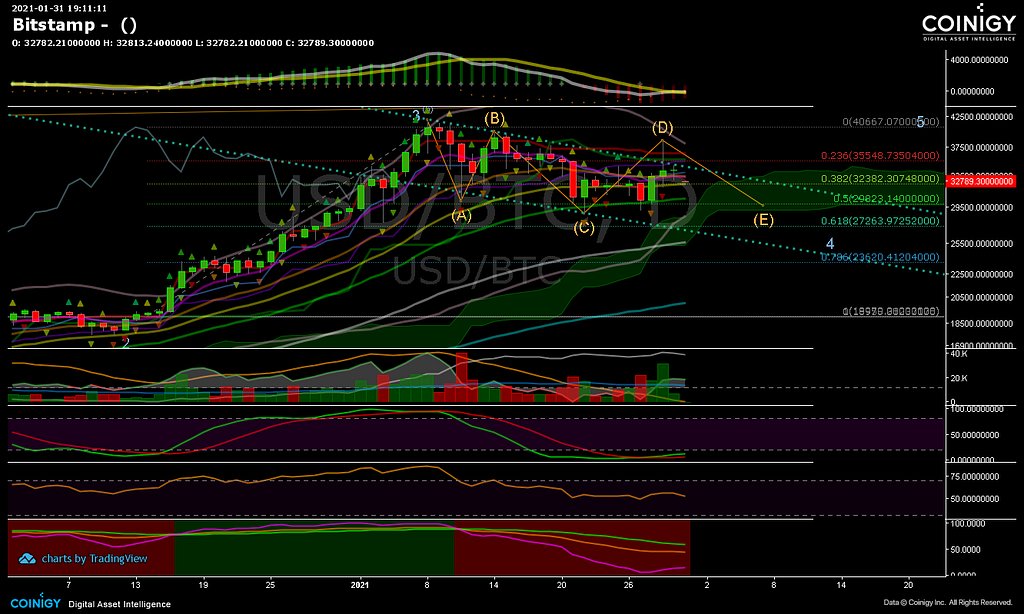

Clear Low Channel

It is very clear that on the hourly chart of Bitcoin, the price remains within a downward channel. For some, it is a bullish flag, but for us, it is a flag that may touch the EMA300 support at 30313.52 again. At the time of this report, the price was supported by the EMA50 exactly at 32662.67.

The truth of the matter is that Wall Street last week played a lot with the sentiment of investors, making them believe that the price of Bitcoin would finally break the resistance of 40k.

We will call this dirty game of the last candles as a simple market test and resistance breaks. We will call this dirty game of the last candles as a simple test of the market and resistance breaks and not to prolong the story so much.

Stop Trading Accumulation

One of the things that new trades must stop doing is trade accumulation. It is exactly what we see within the daily chart of Bitcoin, an ABCD accumulation phase within a bearish channel and under the influence of a correction in Elliot wave 4.

At this point of downside divergence it is important to maintain certainty of the following: (a) we have confirmation of purchase through the crossing of the moving averages of the MACD and the stochastic RSI;

(b) we will have the Bollinger bands approach, which will cause a medium-scale buying interest; © but it is important not to rule out the stop in the 35548.73 and 36465.52 price ranges as a possible squeeze short zone indicated by Tenkan-Sen and our Chande Skoll Sop.

To the above, we must add the fact that we can touch the EMA100 at 32382.29, and if the correction trend continues, the EMA50 at 30531.68. However, we have a strong support evaluated by the Ichimoku Cloud at 29058.32.

The ABC points touched then suggest operating the next break that could lead the price of Bitcoin to seek a new history very close to 50k.

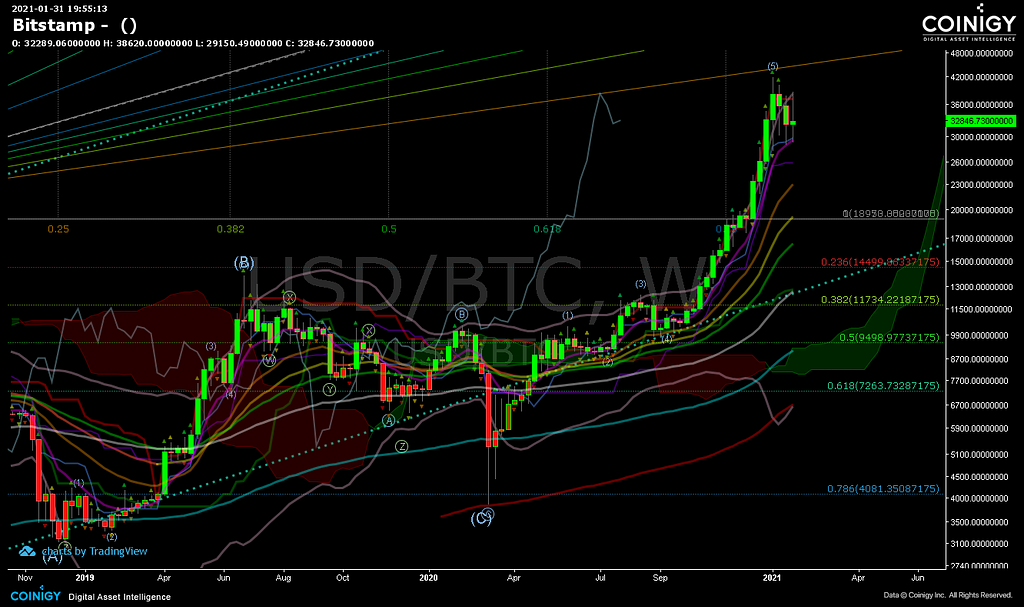

Excessive Overbought

In the short term, we see that the price can go up. But if we move to the weekly period, we see a convergence to the downside that could touch the EMA100 at exactly 18958.15 if something negative happens. The truth is that most of the indicators for this chart time suggest that Bitcoin is overbought, with a need to break the diagonal resistance at 45365.28.

High-grade conspiracy theories suggest that the price of Bitcoin for mid-March and April could be kissing the 10k within a corrective wave and then take an impulsive wave.

With this theory, we do not rule out the possibility of an upcoming ABC correction on the weekly chart.

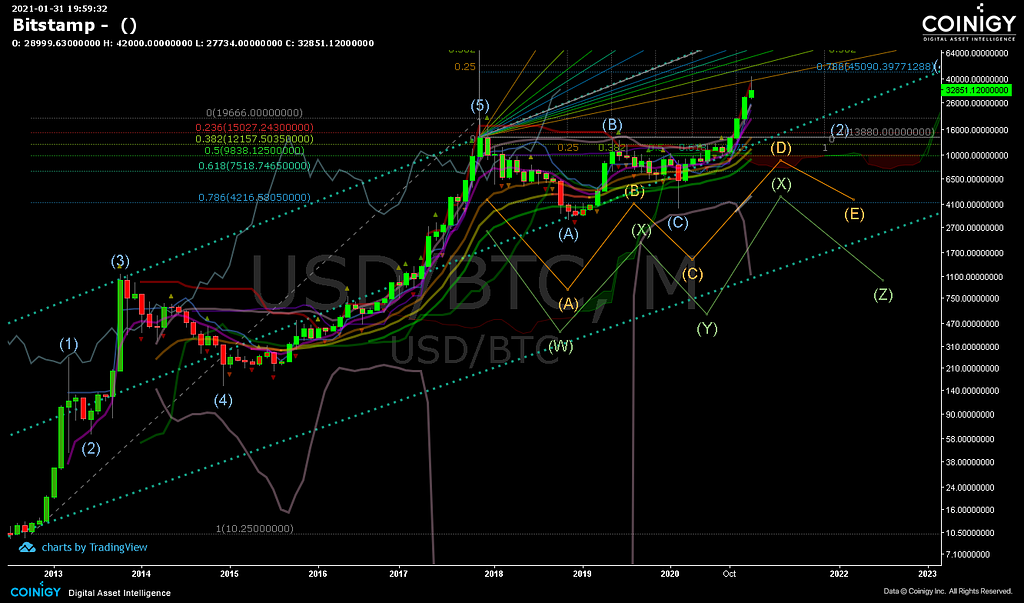

Dangerous Closure

We don’t want to lie to you. There really is a possibility that the pattern of the years 2013, 2017, and 2019 will be repeated.

Old trades will remember that every time Bitcoin hit a top, a bullish sentiment was breathed deeply. But as we know, institutions need immediate results, and if we remember the year 2017 when the futures contracts by the CME were launched, the price was from 1k to 20k, and when it reached this point, thousands of settlements simply began in seconds. The rest of the story you already know.

The difference from 2017 to this year is the similarity that 2021 has with 2013. What is it? You may wonder. Easy to answer: the market, and Bitcoin specifically, is in wave 1 that can mythically reach 100k even this year. But we see a loss of strength in the W pattern that could be ABCD, or who knows WXYZ, and that would be fooling many optimistic trades.

In addition, there is a gradual fear that the monthly closing will happen with a hammer in a bearish sense, indicated mainly by the large shadow of the last candle and simultaneously with the candles of 2013 and 2017. In any case, it is very pertinent to remember that past investments can not be the same in a future time but perhaps the fractals can be fulfilled, and again the theory of chaos gains a new advance within this speculative market.

Liquidity Week

Ethereum (ETH), for its part, also rises in price. Its seven-day average rise was 1.7%, with the price moving between $ 1,300 and $ 1,442. This week, Galaxy Digital, Mike Novogratz’s investment firm, announced the launch of an Ethereum-based mutual fund. The new product, which will be an index fund insurance, will be activated next February. The custody of the funds will be in charge of the Gemini exchange.

The possibility is not ruled out for Ethereum, that the CME, and at the time of launching the future contracts, enter the game making high liquidity in favor of the bears.

Other relevant cryptocurrencies on the market also show ups and downs. Litecoin (LTC), fell 5.7%; Polkadot (DOT) fell 9.7%; and Cardano (ADA) lost 2.9%. Ripple’s XRP, meanwhile, appreciates by almost 80% and is on the weekly top.

If your opinion is contrary, leave it in the comments. Those opinions help us a lot to continue producing this type of rich content.

To assign any of our premium plans and receive all the technical, fundamental information and trade operations, read this post here “Rubikav Premium Plans 2021.”

See you in another review soon! The Rubikav® Team!

Join our group on Telegram https://t.me/rubikavcommunity.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

https://medium.com/media/3b6b127891c5c8711ad105e61d6cc81f/href

It’s Time To Decide! Uncensored Cryptocurrency Market Monthly Review Conspiracy Theory was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.