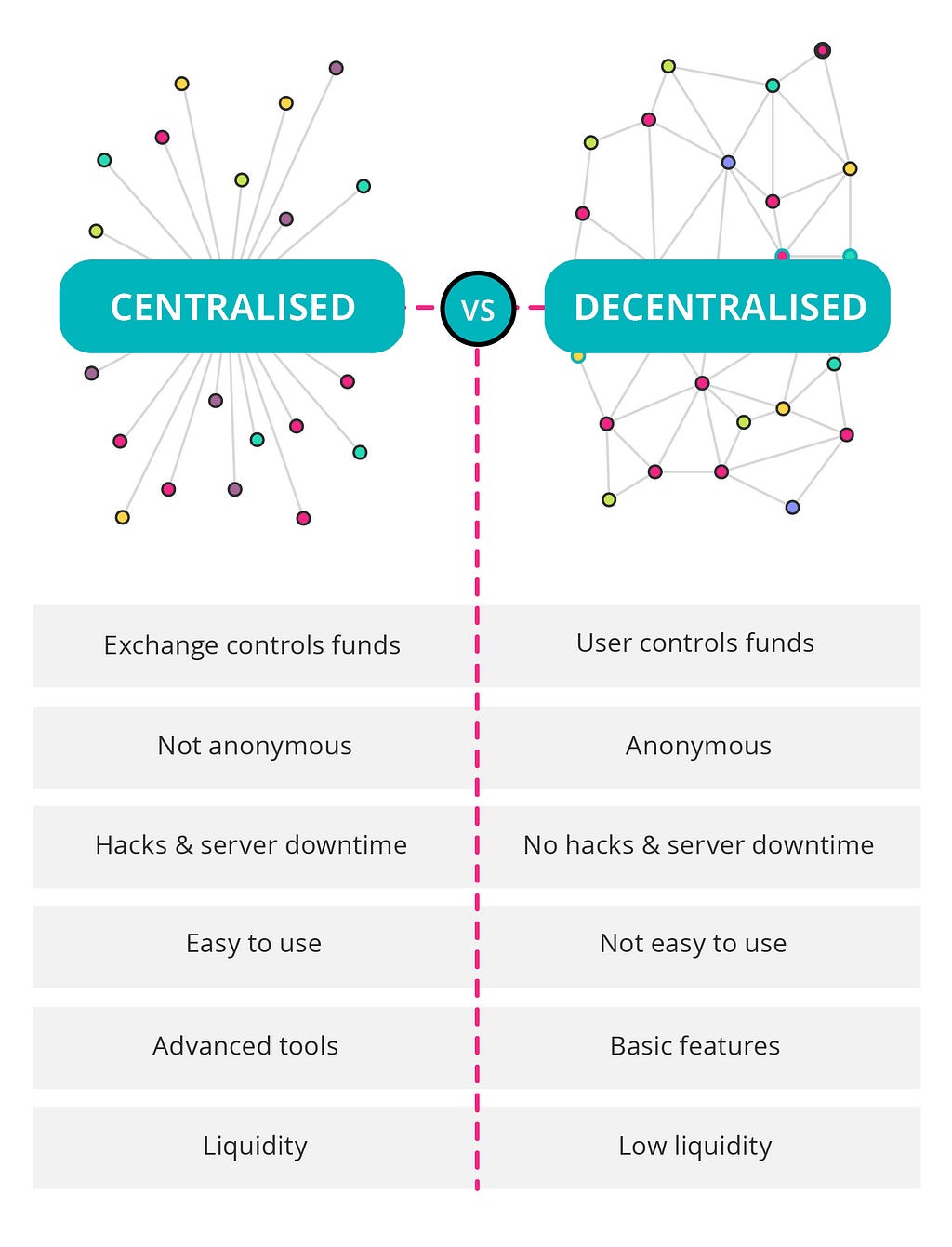

Ever since Bitcoin emerged in 2009, the battle to attract more trading volume from Cryptocurrency investors has been fought hard between Centralized and Decentralized exchanges.

While Centralized platforms had sufficient liquidity and got a profitable inflow of investment from institutional traders, Decentralized platforms challenged their dominance by providing more security and privacy for traders. They are mostly launched on blockchain networks like Ethereum, TRON, and EOS.

What does a Decentralized Exchange denote?

A Decentralized Exchange or DEX refers to a trading platform where users have full control over their funds and trades can be directly executed without the presence of any central authority or intermediaries. The leading Decentralized platforms are Bisq, IDEX, DDEX, Bancor, Bisq, and Binance DEX.

How does a DEX operate?

- All the buy and sell orders raised by the users on the platform are executed on-chain with the help of robust smart contracts that function based on predefined terms and conditions.

- The platform is maintained by numerous nodes that are located across several locations in the globe and there is no single operational server.

- There is no chance of market manipulation by anyone ensuring a safe trading experience.

- The trade gets matched only if there is a buy order matched by an identical and corresponding sell order.

- Automated market-makers provide sufficient liquidity to ensure the prompt on-chain settlement of funds.

The important features of a Decentralized Exchange are

- A robust admin dashboard that takes care of all the business operations efficiently.

- Access to transaction history for the users maintaining a high level of transparency and accountability.

- It is integrated with multiple payment gateways for the smooth processing of peer to peer transactions.

- An inbuilt chat facility is present to ensure uninterrupted communication between the buyers and sellers.

- Instant notifications are issued round the clock carrying information about market movement and price changes to the users.

- 24×7 technical support is available in numerous languages.

- End-to-end compliance is ensured by following the regulations of the SEC, PCI, and GDPR.

The process followed in creating a DEX

- Identifying the business requirements of the firm.

- Establishing a detailed project outline that includes various phases of technical design.

- Integrating the blockchain technology and the smart contract into the trading platform.

- Adding all the necessary features and functionalities for the hassle-free exchange of assets.

- Rigorously testing the platform to eliminate any technical bugs.

- Deploying it on the operational network.

- Issuing regular software updates and maintenance services post-deployment.

The advantages offered by a Decentralized Exchange

- A high level of user privacy is ensured as they are not subjected to a mandatory KYC verification by the platform. This enables anonymous trading as they need not disclose their personal identity and background information to anyone. Faster user onboarding on the trading platform is also facilitated.

- Since the exchange does not hold any of the users’ funds, the counterparty risk is eliminated.

- New tokens and coins can be quickly listed on a DEX compared to the long and cumbersome process to get traded in a Centralized exchange. Custom crypto tokens can be launched on the platform through plugins.

- Atomic swapping facility is available for users to directly exchange their assets without the presence of third parties.

- Orders can be cancelled by the users anytime without paying any gas costs.

- There is no chance of any shutdown as Decentralized exchanges are immune to the regulations issued by authorities and governments.

Some of the limitations of DEX are

- It offers limited options in contrast to centralized counterparts. They do not accept take-profit and stop-loss orders and do not provide margin trading facilities. This affects the user experience and traders might think twice before making the switchover from a Centralized platform to a Decentralized exchange.

- It lacks adequate liquidity when compared to Centralized exchanges. This affects the competitive price of an asset and does not lead to fair trading practices.

- There are some chances of network congestion whenever an on-chain order book is used leading to delays in the settlement of trades.

- Since new tokens are regularly added to the platform, traders who deal with low liquid and highly volatile tokens can experience huge losses.

- Ethereum-based DEX support only ERC20 tokens leading to a lack of choice for the crypto buyers and sellers.

- In case there is a cancellation of an order by a buyer or a seller on the platform, the market-makers may impose high cancellation charges by setting a higher spread of the assets.

- Most of the Decentralized exchanges accept only the use of Cryptocurrencies affecting local traders who mostly utilize fiat currencies for trading.

- The funds of users are not insured in a DEX leaving them fully prone to different risks and vulnerabilities. There is a lack of official support in case of any service issues.

How Decentralized exchanges may become more strong in the years to come

A DEX ticks the right boxes in terms of security and privacy. But, it has to sort out liquidity and user experience issues. Centralized platforms have more liquidity and also accept the use of the leading fiat currencies through their payment gateways. However, the safety of users’ funds is paramount and Decentralized exchanges do a commendable job in this aspect as they are highly resistant to hacking and phishing attacks.

Each user will have various preferences when he is forced to decide between a CEX or a DEX, it depends on his financial background and whether he wants custody or self-custody of funds. Of late, more institutional investors are trading their assets in Decentralized exchanges. With more regulatory bodies passing guidelines for the usage of Cryptocurrencies, DEX’s may be forced to comply with the law to maintain their high level of safety, anonymity, and security

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

https://medium.com/media/3b6b127891c5c8711ad105e61d6cc81f/href

Why a Decentralized Exchange has a strong future ahead in the industry was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.