On April 14th, Coinbase, the largest cryptocurrency exchange in the US, will go public via direct listing to huge fanfare from the crypto community. As a centralized exchange, Coinbase has a lot of fans as well as detractors, but its popularity is in no doubt. Last week, the company released their 2021 first quarter numbers, and it blew expectations out of the water. They reported adding 13 million verified users since the beginning of 2021 and added 147.8% in total asset value held on the exchange. Not only that, but they reported a whopping $1.8 billion in first quarter revenue, compared to $1.3 billion for all of 2020. Those numbers are mind-blowing and are a testament to the massive growing interest in the cryptocurrency space.

Coinbase, founded in 2012, will begin trading on Nasdaq via direct listing under the ticker symbol COIN and will be the first crypto-native company to go public. This listing could have wide-ranging effects on the cryptocurrency space in a lot of different ways. For one, it will be a way to gauge the traditional market’s interest in crypto-related companies and also helps to legitimize crypto in one of the world’s most important financial markets. With Robinhood* planning to go public later this year and Kraken in 2022, they will surely be keeping an eye on this to fine-tune their own strategies for listing.

Another benefit this brings to crypto is that the stock will be talked about, and as interest in it grows, investors and those interested can easily download the app to their phone to familiarize themselves with the company, which in itself could lead down a rabbit hole into crypto markets. This could lead to more capital flowing into the digital ecosystem as Coinbase has one of the most beginner-friendly interfaces and allows people to dip their toes into some free crypto through their Earn program, incentivizing them to learn more.

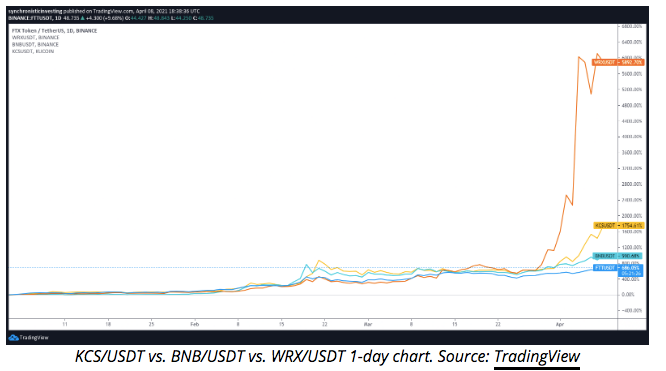

I personally also expect exchange tokens to see a bump. With Coinbase’s valuation at between $100 billion and $144 billion, there’s definitely some room for discussion about fair value market caps for some of the most popular exchange coins. In fact, Binance’s BNB coin cracked $500 on Sunday and pushed past $600 by this morning, bringing it to a market cap of around $85 billion. It also makes you wonder whether Uniswap, the most popular decentralized exchange on Ethereum, is over or undervalued at ~$15 billion in comparison.

On the other hand, one potential negative effect is the possibility that this could pull liquidity and capital away from pouring into the actual crypto market, as some traditional investors could see investing in Coinbase as sufficient exposure to crypto without the need to understand particulars about underlying assets. Additionally, this is yet another example of a centralized authority creating massive waves in a sector that strongly values decentralization. It doesn’t seem inconceivable that Coinbase could be eyeing the success of Binance Smart Chain and thinking of moving in a similar direction.

A lot can be said on either side of the argument of whether centralized crypto companies are at the core of the values the community holds, but it’s hard to deny that Coinbase’s inclusion on the Nasdaq will bring greater attention and more investors to the crypto and DeFi space in general. A lot of eyes will be watching on Wednesday.

Cheers, and thanks for reading!

-JefeDix

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

*Robinhood is primarily a traditional finance company, but I included it due to the fact that they reported 9.5 million active crypto traders during Q1 2021, in comparison to just 1.7 million in Q4 2020.

- *Nothing in this post should be considered financial advice. I am not a financial advisor. Out of crypto protocols mentioned in this post, I hold ETH.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

https://medium.com/media/3b6b127891c5c8711ad105e61d6cc81f/href

Coinbase’s Nasdaq Listing and What it Could Mean for Crypto was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.