DeFi — Back to the Basics

DeFi — or decentralized finance — is an ecosystem of distributed financial applications built on blockchain technology that utilize cryptocurrencies and other digital assets to remove the need for a single governing authority in financial interactions. This addresses multiple problems that exist in the current traditional financial system that was recently highlighted in the Reddit meme stock craze. First, blockchain technology allows for the near-instant transfer of assets and can potentially reduce the current T+2 settlement time from days to seconds. Second, due to the distributed nature of blockchain ledgers, no entity could singlehandedly block trades or close positions like various brokerages such as Robinhood recently did to mitigate their own risk.

It’s not only the exchange settlement networks that are antiquated, current payment systems are similarly slow and expensive. In retail operations, the transaction doesn’t end at the swiping of your card at the register. There’s an entire back end system clearing those transactions, which is why there’s that ‘Pending’ section for recent purchases on your credit card bill. Additionally, sending money across international borders is not only slow, but riddled with fees. The current infrastructure that utilizes the SWIFT payment system (Society for Worldwide Interbank Financial Telecommunications) can take an average of 3 to 5 days to settle and various intermediary banks along the way take unpredictable fees.

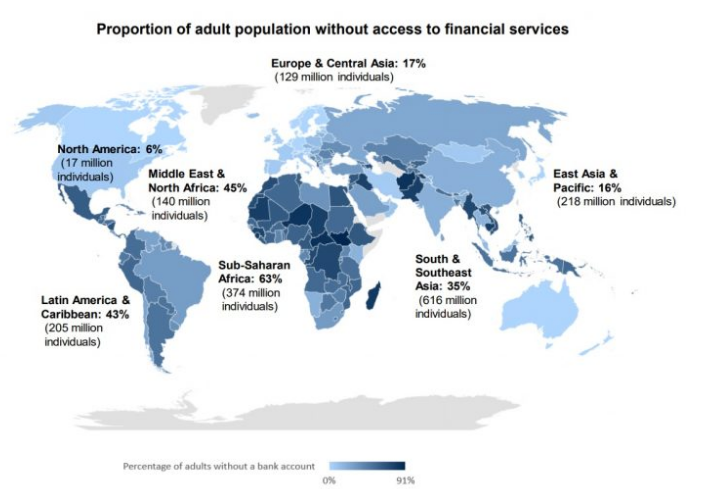

This underpins the unfortunate reality that not everyone has access to strong financial systems. According to the World Bank, about 1.7 billion adults remain unbanked as of 2017. Even for those with a bank account, if the country’s economy is struggling (e.g., hyperinflation in Venezuela or Lebanon), banks or other financial institutions cannot reliably provide the same functions as those in developed countries. And this isn’t just a problem for those in developing countries; even in the United States, the Federal Reserve estimated in 2018 that nearly 22% of US households were underbanked. Access to financial services has been found to be crucially important in reducing inequality.

Additionally, centralized systems lack transparency. Despite regulation and laws regarding transparency, for most retail investors, there’s no way to fully know what happens behinds the scenes at these financial institutions. The recent halting or limiting of certain stocks on Robinhood and other exchanges was explained by CEOs in corporate speak as necessary for remaining in compliance and managing their own risk, leaving some customers skeptical. Similarly, the 2008 financial crisis, where Lehman Brothers and other banks masked high-risk subprime loans as safe investments, underpins the need for more transparent infrastructure.

DeFi aims to address these flaws and make financial services and applications accessible to more people around the world. Since the DeFi ecosystem is still in its nascency, many projects are still in experimental states or changing rapidly. In this post, I’ll categorize some fundamental applications of DeFi as a brief introduction.

Most DeFi applications are currently built on Ethereum, but other blockchain networks such as Polkadot, Cardano, and Flare aim to be faster, cheaper, and more secure alternatives.

So let’s jump into the basics.

Wallets

A crypto wallet is a physical device or an application that interfaces with the blockchain network and manages the private keys to your crypto assets. Like a traditional wallet or a bank account, a crypto wallet allows you to store and send/receive crypto assets.

There are two types of wallets:

Custodial (e.g., Binance, Kraken): a third-party manages the private key on your behalf. These entities reduce the burden of keeping the private keys to your crypto assets safely but also expose you to the risk of losing control of your coins if / when they are hacked (e.g., Mt. Gox).

Non-custodial (e.g., Ledger, Metamask): user-controlled wallet where the user is responsible for the security and storage of the private keys.

Amongst the crypto community, the mantra is “not your keys, not your coins.” Hardware-based wallets such as Ledger are the most secure, but new DeFi users may opt for a quicker, more user-friendly experience that mobile-based wallets like Metamask provide.

Stablecoins

It’s no secret that the price of cryptocurrencies is extremely volatile. This makes assets like Bitcoin and Ether a much riskier store of value in the short term compared to fiat currencies. Stablecoins mitigate this problem by algorithmically pegging their value to other stable assets (e.g., fiat currencies like USD).

There are two types of stablecoins:

Fiat-collateralized coins (e.g., USD Coin, Tether): these stablecoins maintain reserves of equivalent value per minted coin (i.e., to mint a new Tether coin, Tether must keep $1 in their reserves).

Crypto-collateralized coins (e.g., DAI): the value of these stablecoins are pegged via smart protocols voted by DAOs (decentralized autonomous organizations). For example, Maker token holders can vote on the collateral ratio of various crypto assets to algorithmically peg the value of DAI to $1. If the collateral ratio of Ether is 200%, it means that to mint $100 of DAI, $200 worth of Ether must be deposited.

Decentralized Exchanges (DEX)

While popular centralized exchanges like Coinbase and Kraken provide liquidity to facilitate crypto trades, users must trust the exchange to hold their assets on the exchange wallet, opening them up to third-party risk such as the infamous Mt. Got hack. Not to mention their personal information being attached to their assets due to the KYC laws needed to open an account. Decentralized exchanges (DEX) such as Uniswap bypass these intermediaries and use smart contracts to carry out trades on the blockchain network.

Examples:

Liquidity pool-based (e.g., Uniswap, Kyber Network): reserves of crypto assets pooled together for higher liquidity and faster trade execution.

Book-based (e.g., dYdX): buy and sell orders executed by the order book (similar to the mechanism on centralized exchanges).

Lending & Borrowing

Unlike traditional financial institutions that have stringent regulatory policies (e.g., know-your-customer guidelines in anti-money laundering laws), DeFi lenders only require users to provide crypto collateral to take out a loan. On the other hand, users can also earn interest on the crypto assets they supply to the pools. Back in December, Aave implemented its version 2, most notably allowing borrowers to swap their collateral from one asset to another without having to satisfy their loan. Aave also innovated flash loans, uncollateralized loans that must be taken, and paid back within the same block. These have allowed tech-savvy traders to take advantage of arbitrage opportunities to make millions.

Asset Management

2020 saw wider institutional adoption of crypto, reigniting interest in a bitcoin ETF. DeFi users don’t have to wait for regulators to clear such ETFs. Decentralized fund management that algorithmically tracks the performance of various cryptocurrencies or DeFi assets are already available. One example is TokenSets. TokenSets allows users to invest in Robo Sets that automatically trades crypto assets based on underlying metrics. Social Sets allow people to follow baskets designed by traders they follow There are also basket-assets out there, such as the DeFi Pulse Index (DPI) that aim to function like an ETF. Each DPI token is minted by someone providing the necessary ratio of underlying DeFi assets.

Other DeFi Applications

Derivatives (e.g. Synthetix, opyn)

Insurance (e.g. Nexus Mutual)

Lottery (e.g. PoolTogether)

Payments (e.g. OmiseGo, Matic Network)

The Future of DeFi

Although the size of the DeFi ecosystem is small compared to the traditional financial industry it is rapidly growing, having gone from around $25 billion in locked value to over $35 billion already this year. Additionally, recent events ranging from the unprecedented fiscal policies in response to the pandemic to the ongoing “meme stock” frenzy have shown how current systems may be improved with DeFi. The rise of digital assets is going to continue in the future, and the question with decentralized finance is not if but when.

Cheers and thanks for reading!

-JefeDix

Disclaimer: Nothing written here should be considered financial advice. I have positions in BTC, ETH, DOT, and AAVE.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

https://medium.com/media/3b6b127891c5c8711ad105e61d6cc81f/href

DeFi — Back to the Basics was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.