No free lunches in trading either

What payment for orderflow is and how it can hurt retail traders

It’s not exactly news that there are no free lunches, as economists put it. All the platforms we use daily for free, like Facebook, Google, Whatsapp, use data collected from us to make money. Despite the occasional outrage about their practices, a fine imposed by governments here and there, they continue business as usual.

That Google’s incognito mode is not incognito is just the latest appaling revelation. I’d recommend anyone to switch their default search engine to duckduckgo for more privacy.

This all illustrates that indeed if the service is free, you are the product — or your data. Robinhood is no different. As a broker targeting retail investors, they offer commission-free trading on a wide variety of assets. With many of us stuck at home and lucky ones piling up savings, a lot of money has flown into the stock markets. Robinhood recently reached new fame levels thanks to the rise of Gamestop caused by a Reddit community who chose the broker as their go-to platform.

I must admit that I’m not an active Robinhood trader. All my investments in traditional assets are going through wealthsimple, where I have an ISA or are invested on FlatEx, a German broker. While at wealthsimple money under $1000 is managed for free, I pay commission on each trade above that threshold. The same applies to FlatEx. I’ve never used a platform where I could trade commission-free.

It makes you wonder how Robinhood could make their trading free. What surfaced during the SEC hearings is one concept called “Payment for Orderflow”, which played a huge role in how Robinhood was funnelling orders. I’ve also found out that this practice is forbidden here in the UK. Clearly, there must be a good reason for it.

So what is Payment for Orderflow, and why is it controversial?

Payment for Orderflow

Naive as I can be, I had assumed that a lot of trading on Robinhood or similar brokers would be traders trading with each other. A peer-to-peer kind of platform with the occasional market maker, ensuring liquidity inserted.

That was quite wrong as orders often flow to third parties for trade execution. These third parties are paying Robinhood a fraction of a penny per share for directing the order their way. The SEC said in a study that “Payment for order flow is a method of transferring some of the trading profits from market making to the brokers that route customer orders to specialists for execution.”

Robinhood COO Jim Swartout explained its benefits with “our routing system incentivizes the market-makers we have relationships with to compete for order flow by giving you a better price than the one you were quoted at the time your order was placed.”

Nevertheless, if you think about it, customers assume that brokers will be executing their order most efficiently and as fast as possible. But if third parties pay a broker for their order-flow, brokers are incentivized to funnel orders to the party paying them most — basic capitalism. While payment for order flow is legal in the US, it comes with the obligation to disclose information to which extent it’s used on a certain platform. A majority of retail investors on Robinhood have most likely not read these disclosure notes, the same way no one reads T&Cs or privacy policies on websites.

Interestingly enough, Robinhood had just settled a fine of $65 million with the SEC for failing to accurately disclose receipts of payment for routing customers orders to trading firms in 2020. So even if some traders had wanted to read it all, they wouldn’t have gotten the full picture.🤷

It’s obvious why Robinhood and other brokers decide to route order flow to a specified third-party in return for payment, but which kind of third parties pay for the orders?

- Wholesalers: these are firms engaged in high-frequency trading employing algorithmic programs to execute their orders. They account for nearly 20% of daily trading activity and leverage their speed and access to capitalize on liquidity coming from order flows.

- Market makers: as they compete, every order increasing liquidity counts and increases the probability of executing an order most optimally.

- Exchanges: by paying for order flowing to their exchange, they can increase liquidity and promote themselves better.

- Other institutions might also pay for order flow to bundle large block orders, which allows them to fill their own orders without outsourcing them to liquidity providers. In the case of the GameStop frenzy, it turned out that Citadel Capital, a hedgefund losing big time with it’s Gamestop shorts, was paying for order flow on Robinhood. This sparked a lot of debate and outrage when Robinhood shut down its platform for the average trader.

When companies in finance pay for something, it’s normally because they can make money out of it. Payment for orderflow is yet another example. There are several ways firms make financial gains from paying for orders.

- Arbitrage the spread, buy at a lower price than is being sold to the retail investors: when the spread (the difference between the highest bid price and the lowest ask price) is 60.25–60.50, they buy at 60.30 and sell it to the retail investor for 60.50.

- Trading against the retail order: this is somewhat what happened with Gamestop, but this time the retail traders were trading against the hedge fund. Firms paying for orderflow can use the incoming orders to short against them, fill the retail order, and then drop their ask price to trigger a price decrease, allowing them to cover orders from panic-sellers at lower levels. And panic-selling the little guys will, as most of them can’t afford to lose too much. Please note, both scenarios only work out with limit orders.

- Market Orders are most profitable for the trading companies paying for orderflow. They can capitalize on the spread while benefitting by further sending those orders to dark pools and alternative trading systems, paying them for orderflow.

So far, it seems like trading companies and brokers benefit nicely from their orderflow arrangements. Unfortunately, this happens at a cost to the retail traders who’re more often than not unaware of the practice. Downsides for traders include:

- No control over orderflow and orders are not filled efficiently; huge limit orders might not be executed fast unless market makers know big sellers in the books.

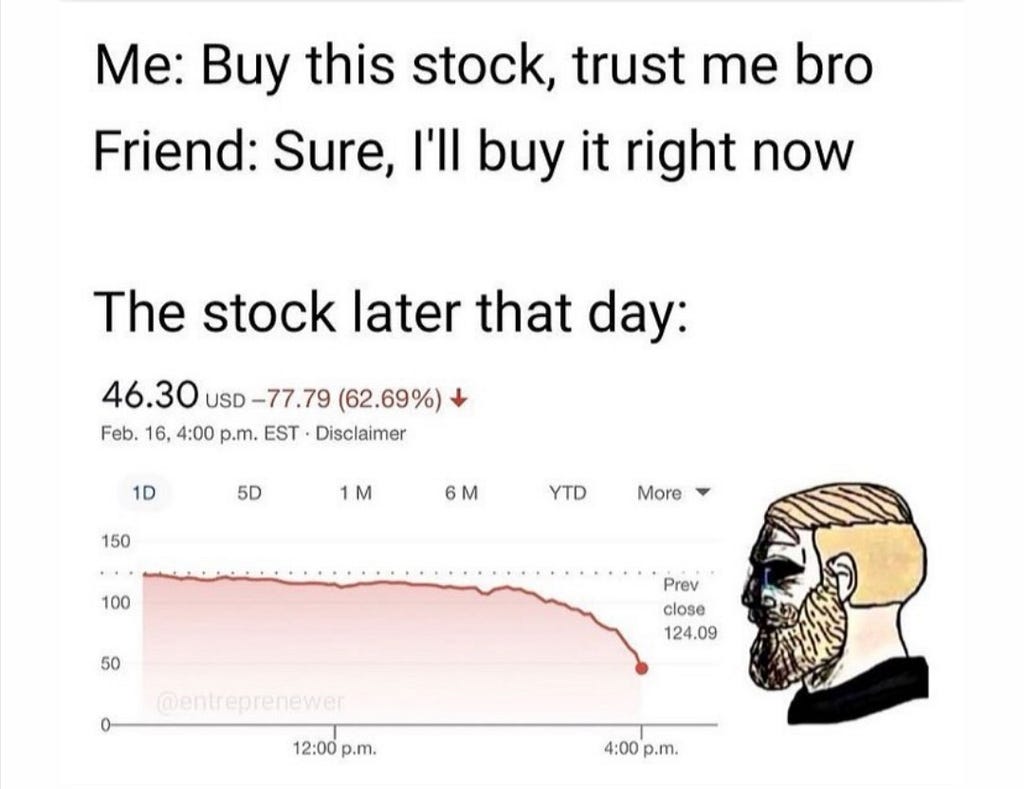

- As outlined above, trading firms can trade against retail orders. It’s quite common that long orders are filled just before the price drops. This fuels the impression of traders that prices will drop as soon as they’ve entered the market. Unfortunately, FOMO often gets the best of us, and we end up buying at the top.

- Execution of orders might take longer as orders are going through yet another middleman (maybe even 2), resulting in them being cancelled altogether. Larger orders will also show up on Level 2 — a real-time service providing access to the order book for NASDAQ stocks, including the best bid & ask prices across various market makers and other participants. Especially when putting large orders, traders are interested in them not showing up in such public avenues to prevent 1. moving the markets on their accounts and 2. have other entities trade against them.

In conclusion, all the gains made by financial firms are financed, as so often, by retail traders thinking they’ve struck a great deal being able to trade for “free”.

As payment for orderflow arrangements are so controversial and come at a high cost to traders, they had been forbidden in the UK in 2012. In the US, as long as they’re disclosed, firms can implement them. When dealing with a “commission-free” platform, take the time to understand how a broker will execute your trades.

To get around the issue completely, you can pick a direct market access broker that’ll place your orders on major exchanges such as the NYSE or the LSE. For some inspiration, for brokers to use in the US, have a look at this article, and for the LSE, they’ve listed them out on their website here. You can easily find more when you “duckduckgo” (it doesn’t sound as posh as google, I must admit), Direct Market Access Brokers and a specific exchange.

Last but not least, don’t forget that crypto doesn’t have any payment for orderflow arrangements. 😉 That being said, DYOR and happy trading!

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

https://medium.com/media/3b6b127891c5c8711ad105e61d6cc81f/href

No free lunches in trading either. was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.