Separation of Money and State: It’s inevitable

Human evolution across time has required the separation of certain institutions from the primary power of the state in order for them to function optimally in serving human society.

In almost all societies across the world, the Church has been separated from the State. Politics was separated from religion. The King cannot function as the High Priest. This concept is one of the many hallmarks of human evolution.

If the King also serves as the High Priest, then the king has so much power over the lives of people, reigning over both the material and the spiritual. It’s way too much power.

“No one man should have all that power” — Kanye West.

As we have evolved, we have recognized the need to separate the state from the money. The state, which has the power to tax people, cannot be the one that has the power to issue currency as well.

Our first attempt at separating the state from the issuance of currency has failed dismally. In its early years, it gave the impression of progress. But in retrospect, it was all a mirage. There is no progress at all.

We tried to design the central bank as an independent institution. In some instances, we decided that the central bank should be privately owned, for example, the Federal Reserve and the South African Reserve Bank. The motivation behind was good. If the government did not own the central bank, then the latter should be somewhat independent. How has that worked out so far?

Then we focused on Goal Independence and Instrument Independence— that the central bank should be able to make its own goals and use its own instruments of choice without interference and influence from the state. How has that worked out so far?

In the worst of cases, central banking has collapsed in countries like Zimbabwe and Venezuela. In the best cases, central banks have given some semblance of being independent. That semblance is enough to fool economics students, who are indoctrinated about central bank independence as if it’s a real thing.

Entrusting the government to create independent central banks was stupid, in retrospect, because the government is the villain that we are trying to keep the central bank away from. The government is the predator. The predator cannot protect the prey. The state was not supposed to be involved in any manner in setting up, governing, regulating, appointing, advising, dealing with the central bank.

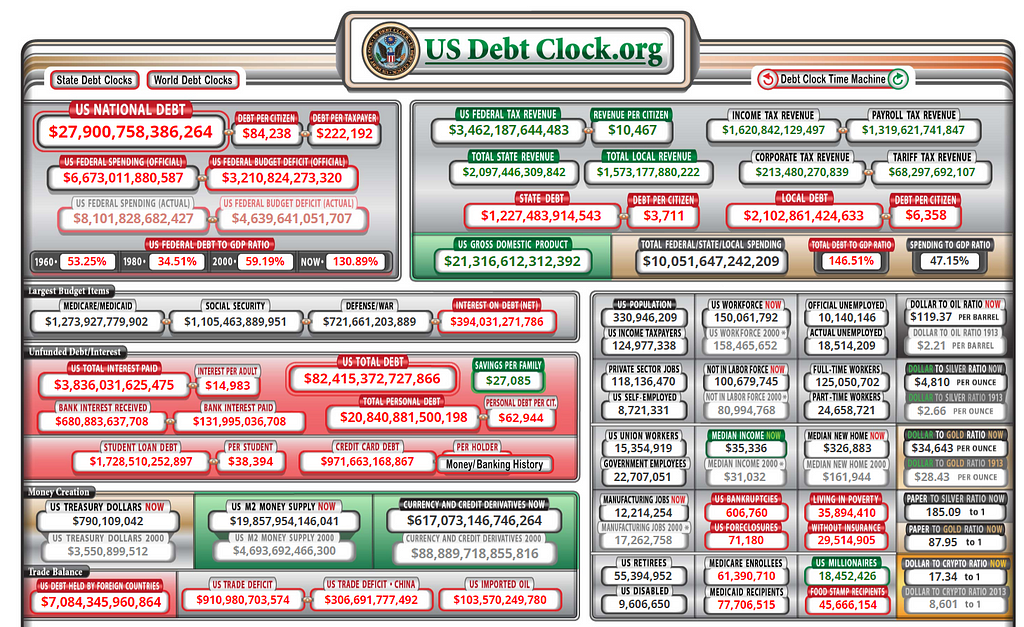

You cannot be a player and a referee at the same time. The proof of the failure of central banking is in the levels of debt, especially government debt. Governments have run perennial budget deficits globally.

Just take a look at the USA debt metrics.

U.S. National Debt Clock : Real Time

To argue that central banks are independent is to deny that which is obvious. It is choosing not to see that which is apparent.

The symbolism in paper currency (faces of former state leaders, emblems, and immaculate stately designs) provides visual evidence of the manner in which the state influences and controls the monetary system by controlling the central bank under the guise of nation-building and nationalism.

Thanks to technology, societies are now in a position where they can separate the state from money. This is not something that will happen overnight. It could take a century or more to evolve, but the pieces of the puzzle are starting to come together. Enter Bitcoin.

Money is a proxy of value and is something that is created out of thin air by central banks.

No-Coiners have criticized Bitcoin bulls for believing in something that is created out of thin air. How can some random digits created by a computer code be valued that high?

Computer programmers literally sit in front of a computer and create value out of thin air. They have been doing this for decades. The reality is most services such as law, digital marketing, and accounting literally create value out of thin air.

In the information age, value can be created out of thin air.

At the current Bitcoin price, one million United States Dollars can only buy 21 Bitcoins. What’s happening?

“It’s a bubble, its inflation, bitcoins are overvalued, tulip mania.”

In my arrogant opinion, what is happening, in the grand scheme of things, is a societal search for a way to separate money from the state. Money is an invisible institution on its own. It’s a system. The Monetary System. It is a very critical institution in the smooth operations of modern societies.

The Monetary System, as an invisible institution, needs to be separated from the state. The cryptocurrency movement is a Pursuit of Happiness. It is liberalism in practice. It is a brave attempt at separating the monetary system from the state. The attempt cannot be deemed to be a success as yet.

To separate the monetary system from the state is and has been The Desire of Ages. The King (state) has the political power to raise taxes. If the king cannot control the monetary system, then he becomes de-emasculated in a way.

Politicians have so much control over us because we use their money. They would not get away with the abuses if we used our money.

The ability of the king to retain the power to govern should solely be based upon his ability to govern. If the ability to enforce taxes is curtailed, the state will only be able to obtain revenue from tokenizing the consumption of public goods and services, under an arrangement where people will only pay for the services they obtain.

Governance systems will become more localized and efficient. Any wasteful expenditure will directly result in a reduced ability of the state to earn revenues as people (the public) can now vote with their monetary energy at every consumption point instead of voting once every 4 or 5 years.

Though political governance systems become much more localized, the monetary system becomes much more internationalized. Bitcoin, for example, is a truly International Monetary System. The IMF, SWIFT, and localized banking systems of the world currently exclude more than 2 billion people (unbanked) out of the 7.7 billion people on earth. This exclusion is a direct result of being centralized and being “guardianed” by elitist bankers singing KYC hymns.

Bitcoin’s attempt at separating money from the state has been going well so far. It’s on its way to being recognized as an asset (digital asset). From there, it will take on gold and get its place as a reserve asset in the digital age. From there, transaction layers could be built upon it such that its monetary energy gets to flow into the global economy as a currency.

The Monetary System has to be internationalized and separated from the state.

In retrospect, it’s inevitable.

Ciao!

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

https://medium.com/media/3b6b127891c5c8711ad105e61d6cc81f/href

Separation of Money and State: It’s inevitable. was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.